The ongoing surge of investor interest in DeFi tokens has placed Mutuum Finance (MUTM) at the center of market conversations. The project’s presale, now deep into Phase 6, has reached 90% capacity with a current token price of $0. 035. Since the presale began, Mutuum Finance has raised $18,800,000 and attracted 18, 050 holders, reflecting rising participation [.] The post Mutuum Finance Review: Expert Consensus on MUTM’s Path to $10 in the Coming Years appeared first on Blockonomi.

Tag: infrastructure

Best Altcoins to Buy as Cycle Is Turning & Promises Alt Season Soon

The post Best Altcoins to Buy as Cycle Is Turning & Promises Alt Seascom. What to Know: Bitcoin Hyper’s modular Bitcoin L1 + SVM L2 architecture enables low-latency smart contracts and DeFi to run natively within the BTC ecosystem. With more than $28 million raised in its presale, YPER is positioning itself as a high-conviction Bitcoin infrastructure play ahead of a potential altcoin rotation. Best Wallet Presale blends institutional-grade MPC security with presale discovery tools and a robust DEX aggregator, aligning its growth with rising on-chain activity. Aster offers a MEV-free perp DEX with extreme leverage and yield-bearing margin mechanics, creating direct exposure to resurging derivatives volatility. Altcoin season indicators are starting to flicker even while most portfolios still feel like a bear market hangover. Only around 5% of the altcoin supply is in profit, a level that historically lines up with capitulation, forced selling and exhaustion among weaker hands. That kind of reset is usually where new cycles begin to form underneath the surface. And keen eyes are already starting to point out the potential for big moves. Bitcoin’s dominance has marched higher during this phase, with capital crowding into TC as a safe haven while high‑beta assets bleed out. As Bitcoin volatility compresses and price action stabilizes, analysts expect the early rotation phase of an altcoin season to develop. Liquidity typically leaks first into higher‑quality infrastructure and trading venues before it reaches meme coins. You can already see that playbook in motion. On‑chain flows and presale data show capital quietly rotating into Bitcoin Layer 2 infrastructure, next‑generation wallet stacks and execution‑focused decentralized exchanges. These are the rails that will need to scale if a new wave of users and speculative flows really hit the market. Below are three of the best altcoins to invest in 2025 if you are positioning ahead of a potential cycle flip: Bitcoin Hyper, Best Wallet Token, and.

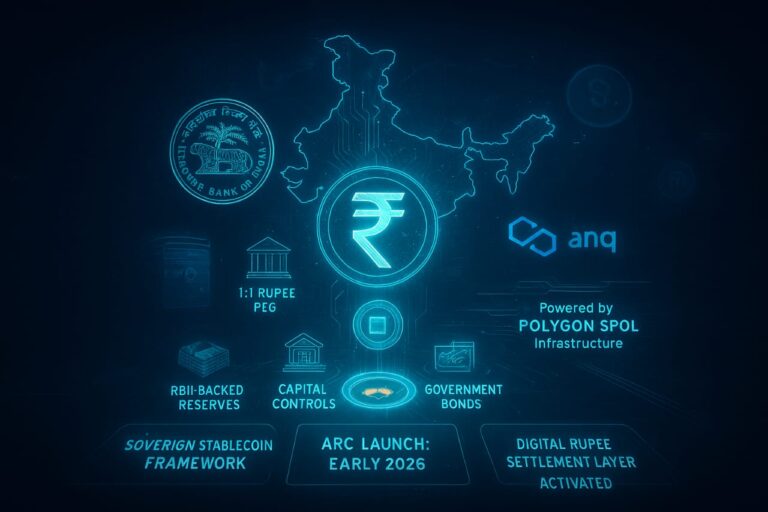

India Unveils Sovereign Stablecoin Framework to Challenge Dollar Dominance

India is stepping into the global stablecoin race with a landmark move. The country is preparing to launch its first sovereign digital currency token, the Asset Reserve Certificate (ARC), a fully rupee-backed stablecoin aimed at tightening capital controls and reducing reliance on the U. S. dollar. The rollout is scheduled for early 2026, setting the stage for one of the world’s largest economies to enter the regulated stablecoin arena with state support. The initiative signals India’s intent to reshape the digital payments market with domestic infrastructure, offering a government-backed alternative to dominant players like USDT and USDC. 🚨BREAKING: INDIA TO LAUNCH The post India Unveils Sovereign Stableco.

“Alarming”: Sen. Wyden demands investigation into JPMorgan Chase’s ties to Jeffrey Epstein

“Alarming”: Sen. Wyden demands investigation into JPMorgan Chase’s ties to Jeffrey Epstein

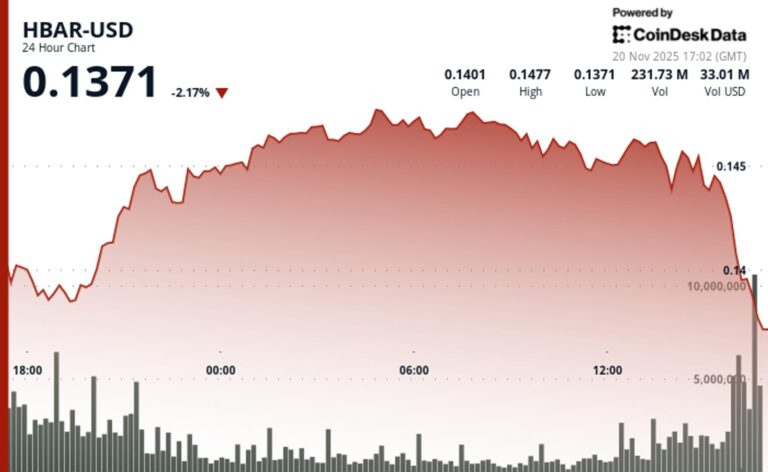

HBAR Faces Fresh Liquidity Alarms After Breakdown to $0.1373

Hedera’s token slipped below key support levels as a late-session trading halt, collapsing volume, and failed recovery attempts point to mounting structural and liquidity stress.

Opera expands MiniPay across Latin America to boost stablecoin payments

The post Opera expands MiniPay across Latcom. MiniPay, a stablecoin wallet built on Celo by the agentic AI and browser company Opera, is connecting USDT (Tether) to real-time payment systems in Latin America. The “Pay like a local” feature, powered by Noah, enables users to pay directly to local shops through Mercado Pago and PIX using their stablecoin balances. Opera announced the update during the Ethereum Devconnect conference in Buenos Aires, Argentina, and it is now available for the MiniPay wallet’s over 10 million users. The Noah-powered “Pay like a local” feature connects to the users’ MiniPay balances through Mercado Pago in Argentina and PIX in Brazil. In Argentina, Mercado Pago’s digital wallet has over 72 million active users and a 68% market share in the country’s payment ecosystem. In Brazil, the dominant financial “operating system” PIX is used by 76% of the population and processes 80% more transactions than credit and debit cards combined. By connecting to both, Opera says MiniPay is providing a bridge for digital dollar holders and travelers to pay like locals in economies where foreign cards often fail. Opera is using the new feature to enable instant utility for crypto users in these markets. Spark says this is about unlocking true spending power Murray Spark, the Head of Commerce at MiniPay, said his company is turning a stablecoin into a powerful and reliable tool for local spending. He added that this is about unlocking true spending power and delivering the smooth payment experience that travelers in the region want. Spark emphasized that the new feature will bridge MiniPay users’ stablecoin balances to the payment infrastructure that is central to Latin America’s commerce. Spark said that with the new feature, users will initiate transfers in MiniPay, see the quoted amount in USD, and MiniPay will handle the conversion and disbursement in local currencies.

9 Reasons Your Property Taxes Keep Going Up Even Though You’re A Senior

Many retirees assume that once they reach a certain age, property taxes will level off or decrease. After all, seniors often qualify for exemptions or.

Why Zero Knowledge Proof (ZKP), Ethena, Cronos, and Pi Lead 2025 Rankings as the Most Reliable and Best Presale Crypto Now

The post Why Zero Knowledge Proof leads 2025 as the best presale crypto, surpassing Ethena, Cronos, and Pi with live utility and real earning potential. Finding the next breakout project often feels like trying to predict the weather, full of noise, claims, and changing conditions. Yet, when you focus on projects that already deliver progress, transparency, and clear development, a few names separate themselves from the rest. These are the tokens that combine readiness with purpose, offering both early-stage access and real technological depth backed by visible progress, measurable traction, and proven functionality across live ecosystems. In this review, we look at four standout contenders shaping conversations around the best presale crypto for investors seeking higher returns and lasting potential in 2025. 1. Zero Knowledge Proof (ZKP): Proof You Can See, Not Just Believe Zero Knowledge Proof has become one of the most closely watched names in crypto because it launched fully built. Rather than raising funds first and promising a product later, the team invested more than $100 million in infrastructure, systems, and hardware before opening its presale. Over $20 million has been deployed in live infrastructure, and another $17 million went toward manufacturing Proof Pods that begin shipping within five days of the auction’s start. At its core, ZKP operates a privacy-first compute network designed to handle AI-based workloads while preserving user confidentiality. The architecture runs on four synchronized layers that maintain data privacy while allowing public verification. Its Initial Coin Auctions (ICAs) occur daily, distributing 200 million ZKP coins every 24 hours. Participants can join with as little as $50 and up to $50, 000 using ETH, USDC, USDT, or BNB. Tokens appear instantly on dashboards once each auction closes, removing delays and uncertainty. Adding a physical dimension, the Proof Pods perform real computational work and.

OpenTrade partners with Figment and Crypto.com to launch next-gen stablecoin yield

The post OpenTrade partners with Figment and Crypto. com to launch next-gen stablecoin yield appeared com. OpenTrade has introduced a new category of stablecoin yield products in partnership with Figment, the world’s largest independent staking provider, and with custodial support from Crypto. com, according to details shared with Finbold on November 14. The new product, OpenTrade Stablecoin Staking Yield Powered by Figment, delivers an average annual percentage rate (APR) of around 15% on stablecoins, based on historical data and market conditions. It combines staking rewards from Solana (SOL) with OpenTrade’s institutional-grade yield infrastructure and a hedging strategy that offsets price volatility of the staked tokens. Higher yields with the peace of mind of an institutional service Figment is bringing its “safety over liveness” approach, that allows institutional investors to earn staking-based returns while avoiding exposure to decentralized lending markets. The platform’s infrastructure includes legal protections for institutions not typically available in DeFi lending. Under the partnership, Crypto. com provides custodial services for SOL tokens, which are held in segregated accounts. Investors are granted a security interest in the custodied assets, which remain fully separated from the exchange’s operational funds. “We’re bringing our battle-tested infrastructure and security mindset to stablecoins to offer customers exceptional yield opportunities with the peace of mind of an institutional service,” said Andy Cronk, Co-founder and Chief Product Officer of Figment. The combined model has historically produced yields more than double Solana’s native staking rewards of around 6. 5% to 7. 5%. Jeff Handler, Co-Founder and CCO of OpenTrade added: “As stablecoin usage and demand for stablecoin yield solutions amongst exchanges, wallet providers, and other fintechs has continued to surge, we have been working closely with Figment to build and deliver a new stablecoin yield offering that improves on existing options in.

Shocking 54.9% Crash Sends Shockwaves Through Crypto Market

The post Shocking 54. 9% Crash Sends Shockwaves Through Crypto Market appeared com. In a stunning development that has sent shockwaves through the cryptocurrency community, the YU stablecoin has dramatically depegged from its $1 target. According to Wu Blockchain reports, this YU stablecoin depegs event has caused the token to plummet to just $0. 42, representing a catastrophic 54. 9% loss in value within 24 hours. What Exactly Happened When YU Stablecoin Depegs? The YU stablecoin depegs event represents one of the most significant stablecoin failures in recent memory. Stablecoins are designed to maintain a consistent value, typically pegged to traditional currencies like the US dollar. When a YU stablecoin depegs situation occurs, it indicates serious underlying problems with the token’s stability mechanisms. This particular YU stablecoin depegs incident saw the token lose more than half its value almost overnight. The rapid decline suggests that either: Market confidence evaporated suddenly Liquidity pools became insufficient Technical issues compromised the peg mechanism External market pressures overwhelmed the stability protocols Why Should Crypto Investors Care About This Depegging? When any stablecoin experiences depegging, it serves as a crucial reminder of the risks inherent in cryptocurrency investments. The YU stablecoin depegs event highlights several important considerations for investors: First, it demonstrates that even assets marketed as “stable” can experience extreme volatility. Second, the YU stablecoin depegs situation underscores the importance of understanding the underlying mechanisms that maintain a token’s peg. Moreover, this YU stablecoin depegs incident affects: Investor confidence across the crypto space Trust in Bitcoin-native protocols like Yala Regulatory scrutiny of stablecoin projects Future adoption of similar financial instruments How Does This Impact the Broader Crypto Ecosystem? The ramifications of this YU stablecoin depegs event extend far beyond just YU holders. Stablecoins serve as crucial infrastructure within the cryptocurrency ecosystem, facilitating trading, lending, and decentralized finance operations. When a YU stablecoin depegs situation occurs, it can create ripple.