More than 8, 000 flights have already been canceled through Monday due to the winter storm impacting the Northeast. More delays and cancellations are expected. Jason Allen reports from Boston Logan Airport and Willie James Inman has more on reversed changes to airport security amid the partial government shutdown.

Tag: government

Dogecoin Price Attempts 31% Breakout Despite DOGE Whale Pressure

The post Dogecoin Price Attempts 31% Breakout Despite DOGE Whale Pressure appeared com. Key Insights: Dogecoin price faces heavy pressure from whale selling and weak market sentiment. A 31% breakout needs DOGE to clear $0. 15, $0. 16, and $0. 193 soon. Falling under $0. 13 puts new lows back in play despite the wedge bounce. Dogecoin price is trying a 31% breakout this week, but the chart still shows mixed signs. DOGE has bounced from the lower line of a falling wedge, an otherwise bullish pattern. But the cryptocurrency still needs to clear $0. 15, $0. 16, and $0. 193 before the breakout becomes real. The crypto market is weak, so the move is still not safe. All signs together show that the DOGE price is in a tight spot, and the next few levels decide what comes next. But these levels aren’t the only ones stressing out a breakout move. Dogecoin Price Needs Key Levels To Confirm Strength Dogecoin price sits well inside a falling wedge pattern. This pattern often shows that sellers are getting tired. DOGE touched the lower line and bounced up, which is a good early sign. But the chart still has three strong barriers. DOGE must rise above $0. 15 first. If it clears this, the next barrier is $0. 16. The final line is $0. 193. Only when DOGE moves above all these levels can traders call it a 31% breakout attempt. 13, the trend becomes weak again. Prices can then drop to new lows if the market turns more negative. This is because $0. 13 is the line where the price stopped falling before. When a line like this breaks, it usually means sellers are in control again. The market outside Dogecoin also matters. Bitcoin is weak, and many altcoins are still under pressure. When the bigger coins stay under stress, smaller coins find it hard.

Dow Jones futures fall due to risk aversion, Fed outlook

The post Dow Jones futures fall due to risk aversion, Fed outlook appeared com. Dow Jones futures decline 0. 30% to trade below 46, 550 during European hours ahead of the opening of the United States (US) regular session on Tuesday. Moreover, the S&P 500 futures and Nasdaq 100 futures are down by 0. 47% and 0. 61%, with trading near 6, 650 and 24, 700, respectively, at the time of writing. US index futures slip as traders turn cautious ahead of delayed economic releases, including a key jobs report due later this week. The data will offer fresh insight into the health of the US economy following the government shutdown. Risk aversion increases amid declining US Federal Reserve (Fed) rate cut bets for December. The CME FedWatch Tool suggests that financial markets are now pricing in nearly a 49% chance that the Fed will cut its benchmark overnight borrowing rate by 25 basis points (bps) at its December meeting, down from 67% probability that markets priced a week ago. Federal Reserve Vice Chair Philip Jefferson noted Monday that risks to the labor market now outweigh upside risks to inflation, while stressing that the Fed should proceed “slowly” with any additional rate reductions. Wall Street ended lower on Monday’s regular session, with the Dow Jones sliding 1. 18%, the S&P 500 falling 0. 92%, and the Nasdaq 100 losing 0. 83%. US equities came under pressure as sentiment toward the AI trade soured ahead of Nvidia’s earnings due Wednesday. Investors are preparing to scrutinize the results amid concerns over stretched AI valuations, even though the chipmaker is widely expected to beat forecasts again. Earnings from Target and Walmart will also be eyed. Dow Jones FAQs The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated.

11/12: The Takeout with Major Garrett

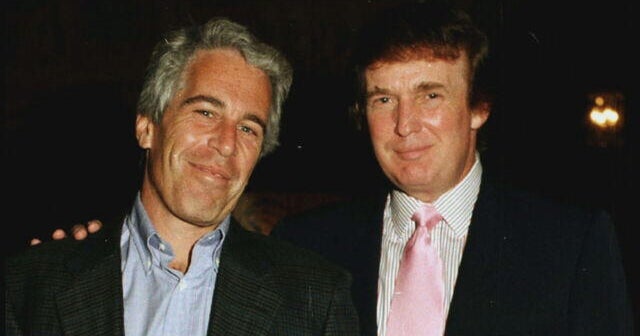

House to vote on ending government shutdown; Jeffrey Epstein said Trump “knew about the girls” in 2019 email to author Michael Wolff.

Watch live: Johnson gives remarks on Day 29 of shutdown as pressure mounts

House Speaker Mike Johnson will hold his daily press conference Wednesday morning as pressure mounts on both sides of the aisle to reopen the government after funding lapsed nearly a month ago. Johnson teased earlier this week that Republicans are working to develop a GOP replacement for the Affordable Care Act and the expiring tax…

JMU suspends fan recorded shouting at Earle-Sears

JMU has suspended the fan who heckled Virginia Lt. Gov. Winsome Earle-Sears at a football game last weekend.

Three ex-Shin Bet chiefs to High Court: Cancel Netanyahu’s appointment of David Zini

Three ex-Shin Bet chiefs to High Court: Cancel Netanyahu’s appointment of David Zini

Three ex-Shin Bet chiefs to High Court: Cancel Netanyahu’s appointment of David Zini

Three ex-Shin Bet chiefs to High Court: Cancel Netanyahu’s appointment of David Zini