DOGE price retreats to $0. 16 support level following last week’s 5. 2% surge driven by speculative asset interest after Trump’s tariff comments, with technical indicators showing bearish momentum. (Read More).

Tag: follow-through

HBAR News: HBAR Price Drops 16% Weekly but Holds Flat After Breakdown

The post HBAR News: HBAR Price Drops 16% Weekly but Holds Flat After Breakdown appeared com. HBAR price drops 16% weekly but holds flat post-breakdown, leading to “bear trap” speculation due to weak follow-through and crowded short positions. This kind of crowded positioning often fuels the conditions. It creates a bear trap risk. This is where the price briefly turns around upwards. It forces shorts to close their positions, losing money. The price breakdown of the HBAR has happened, yes. But this is a dangerous positioning. It is not safe to assume that the move will go uninterrupted. HBAR’s Breakdown and Potential for a Bear Trap Rebound One move could cause an HBAR price rebound. This could strike at short liquidations. The key reason for a bear trap is contained in the price chart. HBAR broke down below the neckline. However, the follow through has been weak. At the same time, we have the Relative Strength Index has fallen 16% over the last week. This resulted after a head and shoulders pattern completed. However, the price held flat for the past 24 hours. This caused speculation of a possible “bear trap.” Despite being highly shorted, some analysts believe that HBAR could briefly turn around to the upside. The fall came on the token breaching a key support level. 14957. Recent trading saw a 0. 4% drop. This was to around $0. 16 before recovering. Institutional selling was seen at significant resistance levels. Some analysts predict a possible rise to $0. 22 in late November. A range of $0. 16 to $0. 30.

BTC Eyes $96.8K, Breakout or Bull Trap?

The post BTC Eyes $96. 8K, Breakout or Bull Trap? appeared com. Key Insights: $96. 8K is the key level-breakout targets $100K, rejection opens downside risk again. Relief bounce is building but needs strong follow-through to confirm any trend shift. Weekly RSI divergence hints at momentum shift, but confirmation depends on price strength. BTC Eyes $96. 8K, Breakout or Bull Trap? Weekend Levels to Watch Bitcoin was trading just above $96, 400, showing limited movement ahead of a key level at $96, 830. This resistance has now become the main short-term focus for traders looking to confirm the next move. Price has rebounded slightly in the last 24 hours, up 0. 60%, while still down nearly 6% over the past week. Market watcher LennaertSnyder pointed out that he’s monitoring this level closely. “Key resistance is still at ~$96, 830,” he noted. A break above it could open the door toward the $100K-$101K area. On the other hand, a quick rejection after testing it might invite short setups. Both directions remain possible, depending on how price reacts near this zone. Relief Bounce Develops on Lower Timeframes On the 1-hour chart, Bitcoin has been climbing slowly off a recent low near $94,400. Short-term momentum has improved, with a series of higher lows forming as price presses toward $96, 400. A recovery is in motion, but confirmation requires more strength. Trader ElonTrades summed up the setup simply: “TC relief bounce incoming.” Volume has risen slightly, and RSI is pushing toward neutral levels. A break above local moving averages could give bulls a bit more room to push higher-at least for now. Weekly Chart Shows Divergence Between Price and RSI On the weekly timeframe, Bitcoin’s price was holding a higher low, while the RSI indicator moved to a lower low near 40. This type of divergence often signals a pause or reversal, especially when visible on higher timeframes. KarmanAsgar wrote, “BULLISH DIVERGENCE ALERT.

Why XRP stays muted despite whale transfers and rising STH demand

The post Why XRP stays muted despite whale transfers and rising STH demand appeared com. Key Takeaways Are XRP whales becoming more active? XRP just recorded 716 whale transfers over $1 million, its highest spike in four months. Are traders positioning for a bounce? Maybe. Short-term holders are accumulating and derivatives remain stable. Are Ripple [XRP] traders ready for a bounce? Short-term holders accumulated during the recent drop, while XRP recorded its highest whale transaction count in four months. With derivatives positioning stable, confidence appeared to build beneath the surface. Whale activity surges as STHs buy XRP logged 716 whale transfers above $1 million its busiest day in four months! Glassnode’s HODL Waves chart showed a clear uptick in the 1-3 month and 1 week-1 month bands. It meant that capital has been rotating into XRP rather than long-term holders distributing. Derivatives stay calm despite spike Building on this, XRP’s Derivatives market has been showing a notably restrained response. Aggregated Open Interest (OI) has held steady around $1. 30 billion over the past week, even as Spot-side volatility picked up. Funding Rates were marginally positive near 0. 0057. So there’s neither aggressive long-side leverage nor overcrowded shorts. XRP’s recent activity is being led by Spot accumulation. Price pressures persist XRP’s daily chart showed the token struggling to break past key resistance levels. At press time, all major EMAs (the 20, 50, 100, and 200) were above spot price. 24, showing limited buying follow-through after last week’s brief rebound. Volume has also thinned compared to the.

‘$1 Million BTC’ Advocate Mow Points to Bear Trap Setup as Bitcoin Loses $100,000

The post ‘$1 Million BTC’ Advocate Mow Points to Bear Trap Setup as Bitcoin Loses $100, 000 appeared com. Bitcoin has been in a slump over the last three days, losing about 10% of its market value as the main cryptocurrency fell from around $108, 000 to about $97,000. The market went down fast, hitting key short-term levels and pushing out positions that had been untouched since October. Samson Mow, the face of the ongoing $1 million Bitcoin debate, dismissed the whole decline with one comment, calling it an “obvious bear trap.” Glassnode recorded the largest realized-loss print of the quarter during the drop, when coins in the 3-6 month age band moved and roughly $600 million were lost within one hour. This cohort usually reflects holders who are not highly reactive, so seeing them exit in size signals that frayed nerves finally broke. The Bitcoin price is behaving in a similar way. When it fell to $97,000, it was snapped up straight away by the spot markets once the forced liquidation waves had passed. Most of the pressure came from overextended positions rather than widespread distribution. Cleanup Derivatives desks pointed to three concentration zones around $101, 000, $99,500 and $97,800 where old longs were wiped out. Once those pockets were cleared, the tape no longer showed the aggressive follow-through that you would normally see with a deeper unwinding. You Might Also Like When you put it all together, the mix of local capitulation, liquidation-driven flow and fast spot response makes it look like the move was more of a cleanup than a structural break. That is the background behind Mow’s comment, and it keeps the focus on how Bitcoin is doing around the $97,000 mark now that forced selling has passed. Source:.

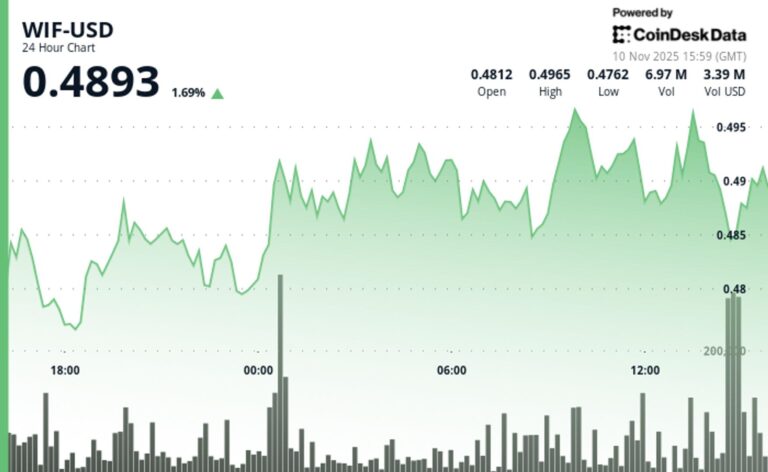

WIF Surged 5% to $0.497 Before Retreating as Profit-Taking Emerged

WIF broke above key resistance levels in volatile trading before institutional selling capped gains at session highs.

Bitcoin faces a high-stakes November – CPI shock collides with FOMC

Key Takeaways Is Bitcoin showing signs of a bottom? Bitcoin shorts are being squeezed and spot-led demand is stepping in, but macro uncertainty and sticky inflation keep the trend far from guaranteeThe post Bitcoin faces a high-stakes November CPI shock collides with FOMC appeared first on AMBCrypto.