The post Coinbase Introduces Ether-Backed USDC Loans for US Customers appeared com. TLDR Coinbase has launched Ether-backed loans for US customers, enabling them to borrow USDC without selling their ETH. The Morpho DeFi lending protocol powers the new service and is available in most US states, excluding New York. Users can borrow up to $1 million in USDC, with variable rates and liquidation risks based on market conditions. Coinbase plans to expand this offering to include loans backed by other assets, such as staked Ether (cbETH). The platform’s on-chain lending markets have processed over $1. 25 billion in loan originations backed by $1. 37 billion in collateral. Coinbase has introduced Ether-backed loans for US customers, allowing them to borrow USDC without selling their Ether (ETH) holdings. This new service is available in most US states, excluding New York, and is powered by Morpho, a decentralized finance (DeFi) lending protocol. Customers can borrow up to $1 million in USDC, with variable rates and liquidation risks tied to market conditions. Partnership with Morpho and Expansion Plans In collaboration with Morpho, Coinbase now offers a new way for users to leverage their ETH for borrowing USDC. The integration of Morpho allows Coinbase customers to access DeFi lending products through its platform. Coinbase has also indicated that it plans to expand the loan offering to other crypto assets, such as staked Ether (cbETH), in the future. Coinbase emphasized that the new product adds a flexible borrowing option for those who prefer not to sell their Ether. This feature meets the growing demand for liquidity without requiring the liquidation of digital assets. The integration of Morpho, added to Coinbase in September, has already yielded up to 10. 8% on USDC holdings. Coinbase’s New ICO Platform Restores Access to Token Sales According to Dune Analytics, Coinbase’s on-chain lending markets have already processed over $1. 25 billion in loan originations. These loans.

Tag: decentralized

OpenTrade partners with Figment and Crypto.com to launch next-gen stablecoin yield

The post OpenTrade partners with Figment and Crypto. com to launch next-gen stablecoin yield appeared com. OpenTrade has introduced a new category of stablecoin yield products in partnership with Figment, the world’s largest independent staking provider, and with custodial support from Crypto. com, according to details shared with Finbold on November 14. The new product, OpenTrade Stablecoin Staking Yield Powered by Figment, delivers an average annual percentage rate (APR) of around 15% on stablecoins, based on historical data and market conditions. It combines staking rewards from Solana (SOL) with OpenTrade’s institutional-grade yield infrastructure and a hedging strategy that offsets price volatility of the staked tokens. Higher yields with the peace of mind of an institutional service Figment is bringing its “safety over liveness” approach, that allows institutional investors to earn staking-based returns while avoiding exposure to decentralized lending markets. The platform’s infrastructure includes legal protections for institutions not typically available in DeFi lending. Under the partnership, Crypto. com provides custodial services for SOL tokens, which are held in segregated accounts. Investors are granted a security interest in the custodied assets, which remain fully separated from the exchange’s operational funds. “We’re bringing our battle-tested infrastructure and security mindset to stablecoins to offer customers exceptional yield opportunities with the peace of mind of an institutional service,” said Andy Cronk, Co-founder and Chief Product Officer of Figment. The combined model has historically produced yields more than double Solana’s native staking rewards of around 6. 5% to 7. 5%. Jeff Handler, Co-Founder and CCO of OpenTrade added: “As stablecoin usage and demand for stablecoin yield solutions amongst exchanges, wallet providers, and other fintechs has continued to surge, we have been working closely with Figment to build and deliver a new stablecoin yield offering that improves on existing options in.

Aster Clarifies Tokenomics Amid CMC Confusion

Key Takeaways The Token Unlock Confusion: Miscommunication, Not Policy Change The decentralized exchange Aster just had to put out an emergency clarification after a simple . Read more.

Rapid USDC Mints on Ethereum May Herald Rise in Tokenized Gold Inflows

The post Rapid USDC Mints com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Multiple $250 million USDC mints on Ethereum highlight a surge in stablecoin activity, with the network’s stablecoin supply expanding 65. 5 times since January 2020, outpacing Ethereum’s market cap growth and underscoring its role in on-chain liquidity. COINOTAG recommends • Professional traders group 💎 Join a professional trading community Work with senior traders, research‑backed setups, and risk‑first frameworks. 👉 Join the group → COINOTAG recommends • Professional traders group 📊 Transparent performance, real process Spot strategies with documented months of triple‑digit runs during strong trends; futures plans use defined R: R and sizing. 👉 Get access → COINOTAG recommends • Professional traders group 🧭 Research → Plan → Execute Daily levels, watchlists, and post‑trade reviews to build consistency. 👉 Join now → COINOTAG recommends • Professional traders group 🛡️ Risk comes first Sizing methods, invalidation rules, and R‑multiples baked into every plan. 👉 Start today → COINOTAG recommends • Professional traders group 🧠 Learn the “why” behind each trade Live breakdowns, playbooks, and framework‑first education. 👉 Join the group → COINOTAG recommends • Professional traders group 🚀 Insider • APEX •.

The Next Big Crypto is Here, Version 1 of Protocol Is on the Way in Q4 2025

The post The Next Big Crypto is Here, Version 1 of Protocol Is on the Way in Q4 2025 appeared com. Crypto Presales A new generation of DeFi platforms is beginning to take shape-projects that focus on real utility rather than hype. Mutuum Finance (MUTM) is one of these standout protocols. It is being designed to make decentralized lending more predictable, transparent, and rewarding. The team will release Version 1 of its protocol on the Sepolia Testnet in Q4 2025, bringing core lending mechanics and collateral systems into action. In a market often driven by speculation, Mutuum’s product-first strategy makes it a serious contender for those looking for a strong crypto investment. Mutuum Finance (MUTM) is now in Phase 6 of its presale. The total token supply is 4 billion, and the current price is $0. 035. The next stage will raise the price to $0. 040, reflecting a 20% increase. Around 87% of this phase is already sold, rapidly approaching the 90% mark. Over $18. 5 million has been raised so far, with more than 17, 800 holders on board. The token is available for purchase by cards without upper limits, making it easy for new participants to join before the price steps up. This speed shows strong investor confidence in a new crypto coin that focuses on delivery rather than promises. Product-Driven Design and Core Architecture Version 1 of Mutuum Finance (MUTM) will include all the building blocks needed for a functioning DeFi ecosystem. Liquidity pools will let users deposit assets and earn interest. When someone lends, they will receive mtTokens-digital receipts that track their deposits and earned yield. Borrowers will receive Debt Tokens, representing their outstanding obligations. This simple structure will make it easy for users to understand how their funds move within the system. The platform’s Liquidator Bot will handle automatic liquidations when collateral values fall too low. It will buy back debt positions at a discount, keeping the ecosystem stable.

GalaPump: Revolutionizing Token Launches in the Gala Ecosystem

Gala introduces GalaPump, a token launchpad enhancing creativity and community engagement, offering double rewards and integration within the Gala ecosystem. (Read More).

Best Crypto to Buy Now: AlphaPepe Emerges as the Next 100× Opportunity

But beyond the blue-chip coins, retail attention is shifting toward early-stage opportunities projects that combine transparency, innovation, and explosive [.] The post Best Crypto to Buy Now: AlphaPepe Emerges as the Next 100× Opportunity appeared first on Coindoo.

Uniswap Faces Crucial Support, Ethereum Slows on Upgrade Delays, While BlockDAG’s $430M Presale Dominates the Market

Uniswap is currently hovering near an important price support zone, drawing the attention of analysts and traders alike. Ethereum, on [.] The post Uniswap Faces Crucial Support, Ethereum Slows on Upgrade Delays, While BlockDAG’s $430M Presale Dominates the Market appeared first on Coindoo.

XRP Ledger Stays Strong as Major AWS Outage Highlights Internet Fragility

The post XRP Ledger Stays Strong as Major AWS Outage Highlights Internet Fragility appeared first Popular platforms like ChatGPT, Reddit, Fortnite, Coinbase, and even Amazon itself faced downtime. Yet, the XRP Ledger (XRPL) kept closing blocks as usual and the crypto community is noticing. Millions Disrupted as AWS Goes Down AWS reported “increased error.

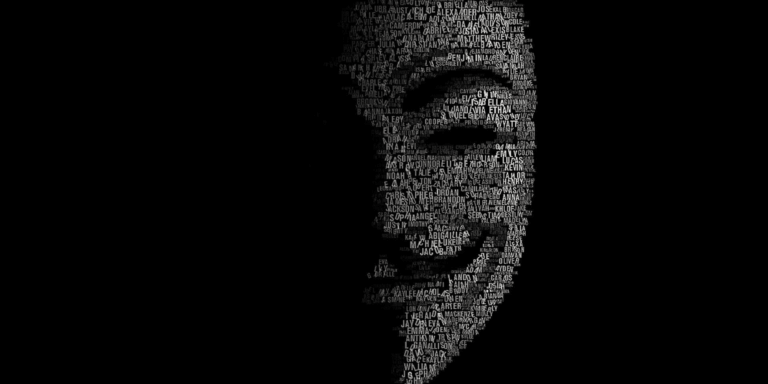

North Korean Hackers Use Blockchain to Hide Malware in New Campaign

TLDR EtherHiding uses smart contracts to host malware on Ethereum and BNB Chain. Hackers compromise WordPress sites to inject JavaScript loaders. Malware hosted on blockchain is hard to detect and remove due to immutability. CLEARFAKE was the first known EtherHiding campaign in September 2023. North Korean state-sponsored hackers are now embedding malicious code into blockchain [.] The post North Korean Hackers Use Blockchain to Hide Malware in New Campaign appeared first on CoinCentral.