The post The Ghost of MT. Gox Will Stop Haunting Bitcocom. Mt. Gox, the defunct Tokyo-based cryptocurrency exchange, still holds around 34, 689 Bitcoin (BTC) ahead of its Oct. 31 repayment deadline. The exchange lost around 650, 000 BTC in thefts that went undetected from 2011 until its 2014 collapse, while about 200, 000 BTC was later found in an old-format wallet. Those coins became the foundation for creditor repayments overseen by court-appointed trustee Nobuaki Kobayashi. In 2017 and 2018, Kobayashi earned the nickname “Tokyo Whale” for selling Mt. Gox Bitcoin to fund fiat repayments. In mid-2024, wallet activity surged again as roughly 100, 000 BTC was moved between Mt. Gox addresses for distribution, though not all represented actual sales. The repayment deadline was extended by a year to give creditors more time to complete claim procedures. With about $3. 9 billion in Bitcoin still in Mt. Gox-linked wallets, this Halloween may again spark concerns about possible sell pressure. Here’s how Mt. Gox’s Bitcoin movements have moved markets throughout its bankruptcy and civil rehabilitation proceedings. Tokyo Whale’s first Mt. Gox Bitcoin sales dump Kobayashi’s first major round of Bitcoin sales took place between September 2017 and March 2018, with blockchain data indicating that the largest offloading occurred on Feb. 6. By mid-March, Mt. Gox’s Bitcoin holdings had fallen to around 166, 000, after Kobayashi disclosed the sale of 35, 841 BTC for 38 billion Japanese yen (about $360 million at the time). That may not seem like a significant supply shock in today’s Bitcoin economy. On Wednesday, Bitcoin had a $2. 24-trillion market capitalization, but back in early February 2018, that number stood at roughly $140 billion, when Kobayashi’s sales represented about 0. 26% of the asset’s total value. Related: $19B crypto market crash: Was it leverage, China tariffs or both? Kobayashi’s Feb. 6 sale also coincided with Bitcoin’s slide to around $6,000, which was the lowest point of that.

Tag: cryptocurrency

Litecoin Tests Lower Bollinger Band Support as RSI Signals Potential Oversold Bounce

The post Litecocom. Terrill Dicki Oct 17, 2025 19: 23 LTC price trades at $90. 78 near critical Bollinger Band support after recent weakness, with technical indicators suggesting potential short-term reversal ahead. Quick Take • LTC trading at $90. 78 (up 0. 2% in 24h) • No major news catalysts driving price action this week • Testing lower Bollinger Band support at $85. 31 level • Bitcoin correlation remains strong amid broader crypto consolidation Market Events Driving Litecoin Price Movement Trading on technical factors in absence of major catalysts has characterized LTC price action over the past week. No significant news events have emerged in the past 48 hours to drive fundamental price movement, leaving Litecoin largely dependent on technical support levels and broader cryptocurrency market sentiment. The modest 0. 18% daily gain represents a stabilization attempt after recent weakness that saw LTC price decline from levels above $95 earlier this week. With Bitcoin showing positive momentum today, Litecoin is benefiting from the correlation effect that typically sees alternative cryptocurrencies follow the leading digital asset’s directional moves. Volume on Binance spot market remains elevated at $99. 9 million over 24 hours, suggesting continued institutional and retail interest despite the sideways price action. This volume level indicates healthy market participation as traders position around key technical levels. LTC Technical Analysis: Oversold Conditions Emerging Price Action Context Litecoin technical analysis reveals the asset trading well below all major moving averages, with LTC price sitting $17 below the 20-day SMA at $107. 94 and $19 below the 50-day SMA at $110. 34. This positioning indicates the current weakness extends beyond short-term volatility into a more sustained corrective phase. The cryptocurrency remains above its 200-day moving average at $99. 34, providing a crucial long-term support reference point. This level has historically served as a significant battleground between bulls and.

Lele Edited: Anthony Pompliano Says Gold Has Plunged 84% in Bitcoin Terms Since 2020

Anthony Pompliano argues that although gold has shown strong performance in dollar terms since January 2020, it has lost 84% of its value when measured in Bitcoin over the same period. Pompliano, the CEO of Professional Capital Management (PCM), made the assertion during his recent appearance on FOX Business, where he framed Bitcoin as a safe haven asset. Visit Website.

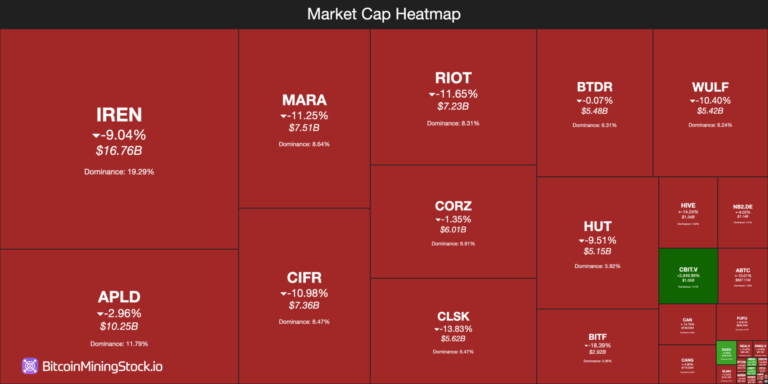

Bitcoin Mining Stocks May Retreat After $94B Rally as Miners Move About 51,000 BTC to Exchanges

The post Bitcoin Mining Stocks May Retreat After $94B Rally as Miners Move About 51, 000 BTC to Exchanges appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Bitcoin mining stocks plunged about 7. 68% after peaking at a combined $94 billion market cap, driven by a Bitcoin price slide under $108,000 and increased miner selling; key miners IREN Limited, Applied Digital, and MARA saw notable market-cap and share-price declines. Market cap fell from $94B to $86. 91B after a BTC dip and miner outflows Miners moved ~51, 000 BTC to exchanges beginning October 9, increasing selling pressure IREN Limited leads the sector with a $16. 76B market cap; MARA shares fell ~11. 25% Bitcoin mining stocks drop: market cap retreats from $94B; read the latest market impact and data-driven analysis. Stay informed COINOTAG coverage. What are Bitcoin mining stocks and why did they fall? Bitcoin mining stocks are equity shares of companies that operate cryptocurrency mining infrastructure or provide related services. These stocks fell after a sharp Bitcoin price correction under $108,000 and elevated miner selling that increased supply on exchanges, which pressured investor sentiment and market capitalization. COINOTAG recommends • Professional traders group 💎 Join a professional trading community Work with senior traders, research‑backed setups, and risk‑first frameworks. 👉.

Binance’s CZ Urges Coinbase to List More BNB Chain Projects

The post Binance’s CZ Urges Coinbase to List More BNB Cha recently shared his thoughts on promoting openness and inclusivity across the crypto industry. In a recent post on X, he suggested that Coinbase should consider listing more projects from the BNB Chain ecosystem. CZ pointed out that Binance has already listed several projects built on Base, while Coinbase has yet.

A Bold Run For California Governor

The post A Bold Run For California Governor appeared com. Pioneering Ian Calderon Bitcoin Vision: A Bold Run For California Governor Skip to content Home Crypto News Pioneering Ian Calderon Bitcoin Vision: A Bold Run for California Governor Source:.