MATIC trades at $0. 38 following a 23% spike in small payment transactions on Polygon network, with over 500, 000 operations recorded in November as adoption accelerates. (Read More).

Tag: consolidation

BTC Price Prediction: Bitcoin Eyes $95,000 Recovery Before Year-End Amid Technical Reset

The post BTC Price Prediction: Bitcoin Eyes $95,000 Recovery Before Year-End Amid Technical Reset appeared com. Rongchai Wang Nov 26, 2025 06: 04 Bitcoin forecast shows potential recovery to $95,000 by December as oversold RSI and key support at $86,000 create buying opportunity for BTC price prediction. Bitcoin’s recent pullback from its November highs has created an intriguing setup for the remainder of 2025. With BTC trading at $87,537 and showing oversold conditions on multiple timeframes, our Bitcoin forecast suggests a measured recovery is likely in the coming weeks. BTC Price Prediction Summary • BTC short-term target (1 week): $92,000 (+5. 1%) • Bitcoin medium-term forecast (1 month): $95,000-$98,000 range• Key level to break for bullish continuation: $94,426 (SMA 20) • Critical support if bearish: $80,600 Recent Bitcoin Price Predictions from Analysts The latest BTC price prediction from market analysts shows a divided outlook. Polymarket participants maintain confidence with targets between $86,000-$88,000 for the near term, suggesting consolidation at current levels. More optimistically, Coingape projects a potential rally to $104,725, anticipating a double-digit surge before any significant correction. TS2. Tech’s analysis focuses on Federal Reserve policy impacts and options expiry volatility around the $87,000 level, which aligns closely with current trading ranges. The consensus among these Bitcoin forecast models points to a range-bound scenario with upside bias, though the magnitude of the next move remains debated. BTC Technical Analysis: Setting Up for Oversold Bounce The current Bitcoin technical analysis reveals several compelling factors supporting a near-term recovery. Bitcoin’s RSI at 31. 78 sits in neutral territory but approaching oversold conditions, historically a precursor to bounce opportunities. The MACD histogram reading of -216. 66 confirms bearish momentum is slowing, though the indicator hasn’t yet turned positive. Bitcoin’s position within the Bollinger Bands at 0. 25 indicates significant compression toward the lower band at $80,380. This positioning, combined with the current price sitting just above the.

Bitcoin Shows A Clear Momentum Reset — Is A Trend Reversal Coming?

The post Bitcoin Shows A Clear Momentum Reset Is A Trend Reversal Coming? appeared com. The dynamic landscape of the Bitcoin market is entering a full momentum reset, the kind that typically appears in the cooling phase between major trend cycles. After a period of decisive movements, the market now finds itself in a state where previous directional force has largely dissipated, allowing for a re-evaluation of its path. A Necessary Reset Before Bitcoin’s Next Big Push In an X post, Swissblock has mentioned that Bitcoin momentum is clearly in a reset phase, and the question now is how long until it flips. Historically, in late February to early April 2025, the bottom required roughly 7 weeks for a full momentum to reset. Moving further back to late June to late September 2024, the correction took close to 14 weeks for a full reset and consolidation before a clear trend emerged. Data shows that the current momentum reset has been underway for weeks, placing BTC right inside the window where past cycles have typically reached exhaustion. This zone historically marks the point where downside pressure weakens and the higher probability of a counter-trend move increases sharply. The crypto market is collapsing. An industry-leading commentary on the global capital markets, The Kobeissi Letter, revealed that on October 6th, just 45 days ago, Bitcoin touched an all-time high of $126,272, with the total crypto market capitalization reaching $2. 5 trillion. However, everything changed on October 10th, when President Donald Trump threatened 100% tariffs on China, shifting the surface of the crypto market. This announcement triggered a chain reaction record of $19. 2 billion in liquidations, the highest ever recorded in a single event, and BTC never truly recovered from the shock. Even when a trade deal between the US and China was reached on October 30th, the liquidation pressures only worsened. Since November 10th, BTC price action has moved.

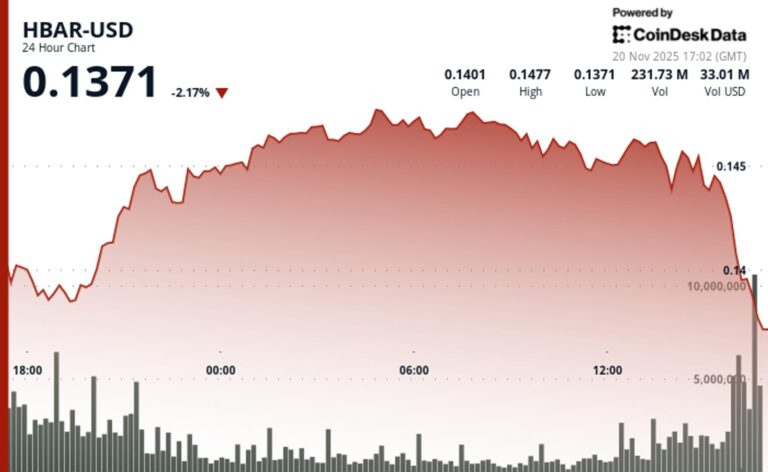

HBAR Faces Fresh Liquidity Alarms After Breakdown to $0.1373

Hedera’s token slipped below key support levels as a late-session trading halt, collapsing volume, and failed recovery attempts point to mounting structural and liquidity stress.

XRP Price Prediction: Targeting $2.67 by December 2025 Despite Recent Pullback

XRP price prediction shows potential for 15% upside to $2. 67 within 4 weeks, with bullish MACD momentum offsetting recent 7. 92% decline from current $2. 31 levels. (Read More).

Capital Flows From Bitcoin ETFs Into AI Presales Like IPO Genie

The post Capital Flows From Bitcocom. Crypto Presales Discover how the crypto market is shifting as billions exit Bitcoin ETFs and flow into AI presales like IPO Genie, redefining the next big opportunity. U. S. Bitcoin ETFs have just seen one of their biggest outflow streaks in months, with over $564 million pulled from institutional funds in a single trading session. Fidelity’s Wise Origin fund led the withdrawals with $263. 9 million, while all twelve U. S. products recorded redemptions. Even with total assets still near $130 billion, investor sentiment is shifting. Portfolio managers are taking profits, traders are cautious, and retail investors are torn between fear of missing out and fear of buying the top. The signal is clear: money isn’t leaving crypto; it’s moving. Capital is rotating from mature assets like Bitcoin ETFs into new opportunities built around AI innovation and early access. Projects such as IPO Genie (PO) are capturing this momentum, blending artificial intelligence with blockchain to create the next wave of high-growth presales before the market catches on. Bitcoin ETF $564M Outflows Signal Market Shift Bitcoin ETFs solved adoption for large players. Tickers replaced private keys. Risk desks blessed exposure. Liquidity poured in and helped support higher floors for price. The tone changed when flows reversed. The most recent print showed more than $564 million in net outflows across the suite, with Fidelity’s Wise Origin contributing roughly $263. 9 million on its own. Reports noted that all twelve U. S. products saw redemptions on the day. Traders called it a wake up call. Liquidity matters in the short run, and the tape felt lighter. AUM near $130 billion remains impressive, but the direction of travel is what sets the mood. For everyday investors, this creates anxiety. They worry about missing a bounce. They also fear exit liquidity for larger players. The message from flows is simple.

Forget ETH’s Strong Market Energy & DOGE’s Q4 Slowdown: BlockDAG’s 50B Cap is Running Out with Only 4.3B BDAG Remaining

The post Forget ETH’s Strong Market Energy & DOGE’s Q4 Slowdown: BlockDAG’s 50B Cap is Running Out with Only 4. 3B BDAG Remaining appeared com. The market is entering a fascinating phase, one where confidence and doubt collide at the same time. Ethereum (ETH) continues to show impressive strength, supported by steady upgrades and growing trust from large institutions. Dogecoin (DOGE), on the other hand, is losing steam, suggesting the market is slowly moving away from hype and toward projects with real structure and measurable scarcity. BlockDAG is gaining momentum by embracing a simple but powerful idea. It mirrors Bitcoin’s approach to scarcity, locking its supply at 50 billion tokens and limiting its presale to 2 billion coins spread across ten price stages from $0. 005 to $0. 03. The hard cap creates a mathematical supply ceiling, and with the BlockDAG (BDAG) presale closing soon, the project sets up conditions that could trigger long-term value growth. Why BlockDAG’s 50B Cap Strategy Matters BlockDAG’s design is intentionally shaped around scarcity. With a total of 50 billion BDAG coins audited and fixed forever, the network introduces permanent deflationary pressure. As its high-speed DAG architecture expands and finds more use cases, this limited supply can amplify demand. This combination of scarcity and performance positions BlockDAG as one of the best cryptos for higher returns. The presale carries this same philosophy. BlockDAG has already secured more than $435 million from over 312, 000 holders. The final 2 billion coins are now being sold through ten planned price stages. The opening price is $0. 005, rising step by step to $0. 03. Each stage creates a clear advantage for early buyers, because once a stage sells out, the next stage becomes more expensive. The time element is the final part of the scarcity design. Once the presale sells out, it ends completely. No extensions and no extra tokens. This prevents dilution and protects long-term value. With the listing price confirmed at $0. 05, BlockDAG provides a.

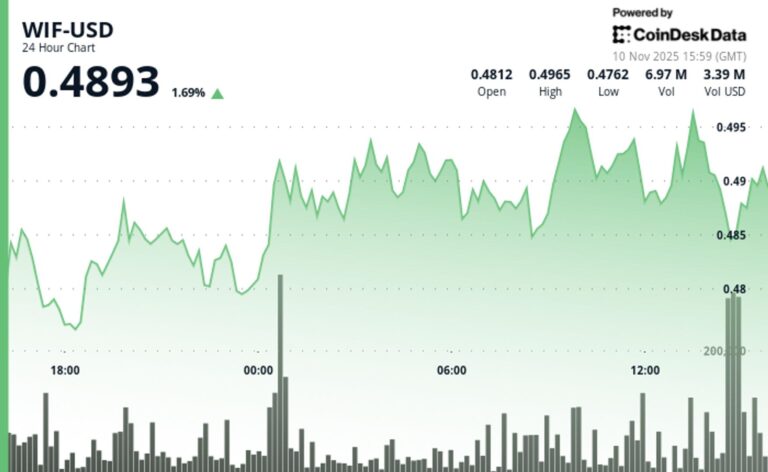

WIF Surged 5% to $0.497 Before Retreating as Profit-Taking Emerged

WIF broke above key resistance levels in volatile trading before institutional selling capped gains at session highs.

WLD Price Prediction: Worldcoin Eyes $0.65 Retest Before Potential Recovery to $0.97 by December 2025

The post WLD Price Prediction: Worldcoin Eyes $0. 65 Retest Before Potential Recovery to $0. 97 by December 2025 appeared com. Timothy Morano Nov 09, 2025 09: 01 WLD price prediction shows mixed signals with bearish analyst targets of $0. 564-$0. 805 for November 10th, while technical analysis suggests critical support test at $0. 65 ahead. Worldcoin (WLD) finds itself at a critical juncture as the token trades at $0. 79, down 3. 76% in the last 24 hours. With analyst predictions diverging significantly and technical indicators painting a mixed picture, this WLD price prediction examines the key levels that will determine Worldcoin’s near-term trajectory. WLD Price Prediction Summary • WLD short-term target (1 week): $0. 65-$0. 75 (-18% to -5%) • Worldcoin medium-term forecast (1 month): $0. 60-$0. 95 range with high volatility expected • Key level to break for bullish continuation: $0. 97 (Bollinger Band upper resistance) • Critical support if bearish: $0. 65 (immediate support) and $0. 26 (strong support floor) Recent Worldcoin Price Predictions from Analysts The latest analyst predictions for WLD reveal significant disagreement about Worldcoin’s immediate direction. CoinCodex presents the most bearish WLD price prediction, targeting $0. 564 by November 10th based on 79% of indicators signaling negative sentiment. This represents a potential 29% decline from current levels. In contrast, Bitget offers a more optimistic Worldcoin forecast with a $0. 805 target for the same timeframe, suggesting minimal upside of roughly 2%. CoinLore sits in the middle with a $0. 775 prediction, implying sideways consolidation. The wide spread between these predictions ($0. 564 to $0. 805) indicates high uncertainty in the market. However, all three forecasts acknowledge the challenging technical environment, with key support at $0. 671 being universally recognized as critical for WLD’s stability. WLD Technical Analysis: Setting Up for Support Test The Worldcoin technical analysis reveals several concerning signals that support a more cautious outlook. WLD currently trades below all major moving averages except the 7-day SMA ($0. 76), indicating persistent selling pressure. The 20-day.

DOT Price Prediction: Target $3.80 by November 15th as Polkadot Breaks Key Resistance

DOT eyes $3. 80 short-term target after breaking above $3. 29 resistance. Technical indicators show bullish momentum building for Polkadot’s next leg up. (Read More).