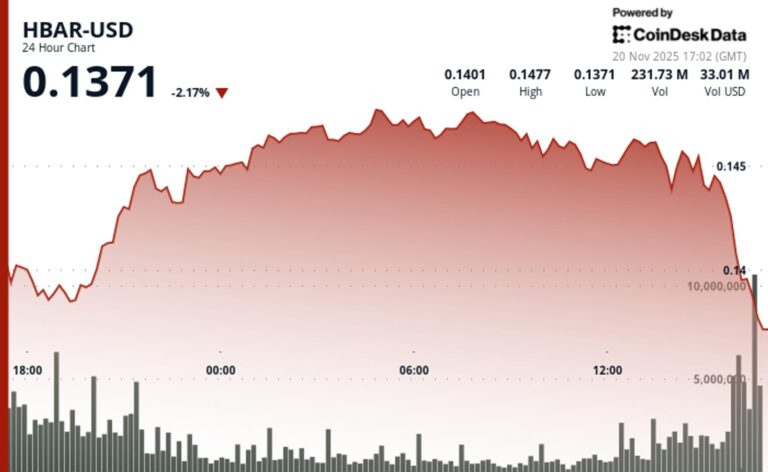

Hedera’s token slipped below key support levels as a late-session trading halt, collapsing volume, and failed recovery attempts point to mounting structural and liquidity stress.

Tag: breakdown

HBAR News: HBAR Price Drops 16% Weekly but Holds Flat After Breakdown

The post HBAR News: HBAR Price Drops 16% Weekly but Holds Flat After Breakdown appeared com. HBAR price drops 16% weekly but holds flat post-breakdown, leading to “bear trap” speculation due to weak follow-through and crowded short positions. This kind of crowded positioning often fuels the conditions. It creates a bear trap risk. This is where the price briefly turns around upwards. It forces shorts to close their positions, losing money. The price breakdown of the HBAR has happened, yes. But this is a dangerous positioning. It is not safe to assume that the move will go uninterrupted. HBAR’s Breakdown and Potential for a Bear Trap Rebound One move could cause an HBAR price rebound. This could strike at short liquidations. The key reason for a bear trap is contained in the price chart. HBAR broke down below the neckline. However, the follow through has been weak. At the same time, we have the Relative Strength Index has fallen 16% over the last week. This resulted after a head and shoulders pattern completed. However, the price held flat for the past 24 hours. This caused speculation of a possible “bear trap.” Despite being highly shorted, some analysts believe that HBAR could briefly turn around to the upside. The fall came on the token breaching a key support level. 14957. Recent trading saw a 0. 4% drop. This was to around $0. 16 before recovering. Institutional selling was seen at significant resistance levels. Some analysts predict a possible rise to $0. 22 in late November. A range of $0. 16 to $0. 30.