The Bitcoin Coinbase Premium Index turned negative as BTC’s RSI hit its lowest level since April, but it could also mark the beginning of a slow recovery. Key takeaways: The Bitcoin Coinbase Premium flipped red as BTC price dropped below $104,000. Bitcoin’s RSI hit its lowest point since April, hinting at a potential bottom zone. Read more.

Tag: bitcoin

Analyst Predicts When XRP Will Hit a New ATH, Citing Bitcoin’s $125K Peak

A market commentator has predicted when he believes XRP and other altcoins could reach their all-time highs, citing the latest Bitcoin peak. For context, Bitcoin (BTC) claimed a new all-time high of $125,725 on Oct. Visit Website.

Bitcoin Market Structure Remains Bullish as High Levels Hold

The post Bitcocom. Key Points: Axel Adler Jr. discusses Bitcoin’s high-level support. Expert insights place focus on levels near $110,000. Market correction viewed as controlled deleveraging. CryptoQuant analyst Axel Adler Jr. discussed Bitcoin’s market maturity, referencing $110K levels amidst controlled deleveraging, according to his statements on X in October 2025. This highlights the market’s stability at high levels, contrasting erroneous $10K support claims, driving investor confidence despite recent volatility at historically elevated price points. Bitcoin’s $110K Support Highlights Market Maturity Recent corrections in Bitcoin’s value are viewed as controlled events rather than a collapse. Spot volumes reached $44 billion and futures $128 billion, with a significant $14 billion open interest drop. Controlled deleveraging keeps the structural market outlook positive, avoiding forced liquidations. “A very mature moment for Bitcoin,” Axel Adler Jr. stated, steering away from outdated narratives about $10K levels. Expert insights reveal a mature market structure supported by high-level price action. Bitcoin’s Resilience and Historical Price Patterns Analyzed Did you know? During the 2020 Covid Crash, Bitcoin experienced a similar market pattern with a sharp decline followed by a robust recovery, eventually reaching new highs. Analysts now see parallel behavior, with current rebounds near historical $100K-$110K levels. Bitcoin’s current price is $108, 422. 46 USD, with a market cap of approximately $2. 16 trillion. Its 24-hour trading volume stands at $85. 84 billion, showcasing a 24. 61% change. Bitcoin’s price dipped by 2. 22% in the last 24 hours, with a further decline over 90 days accounting for 8. 35%, CoinMarketCap reports. Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 05: 55 UTC on October 17, 2025. Experts observe historical trends and current data to assess impact, seeing controlled deleveraging as a stabilizing force in maintaining price resilience above critical levels. DISCLAIMER: The information on this website is.

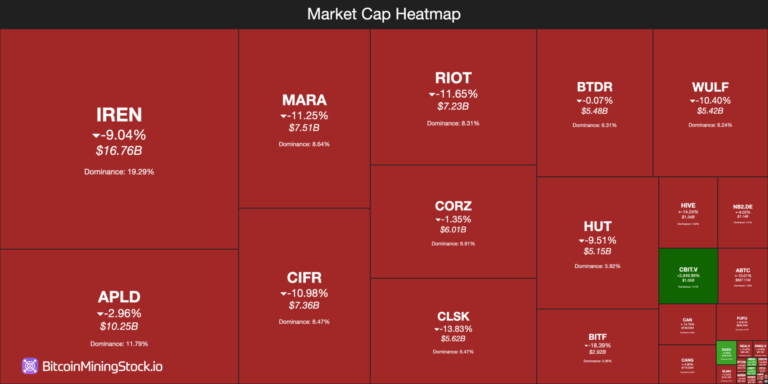

Bitcoin Mining Stocks May Retreat After $94B Rally as Miners Move About 51,000 BTC to Exchanges

The post Bitcoin Mining Stocks May Retreat After $94B Rally as Miners Move About 51, 000 BTC to Exchanges appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Bitcoin mining stocks plunged about 7. 68% after peaking at a combined $94 billion market cap, driven by a Bitcoin price slide under $108,000 and increased miner selling; key miners IREN Limited, Applied Digital, and MARA saw notable market-cap and share-price declines. Market cap fell from $94B to $86. 91B after a BTC dip and miner outflows Miners moved ~51, 000 BTC to exchanges beginning October 9, increasing selling pressure IREN Limited leads the sector with a $16. 76B market cap; MARA shares fell ~11. 25% Bitcoin mining stocks drop: market cap retreats from $94B; read the latest market impact and data-driven analysis. Stay informed COINOTAG coverage. What are Bitcoin mining stocks and why did they fall? Bitcoin mining stocks are equity shares of companies that operate cryptocurrency mining infrastructure or provide related services. These stocks fell after a sharp Bitcoin price correction under $108,000 and elevated miner selling that increased supply on exchanges, which pressured investor sentiment and market capitalization. COINOTAG recommends • Professional traders group 💎 Join a professional trading community Work with senior traders, research‑backed setups, and risk‑first frameworks. 👉.

Top Crypto Coins to Invest in October 2025: AlphaPepe Presale, Chainlink Growth, and Ethereum Momentum

Analysts are now pointing to three very different plays investors should watch: the viral AlphaPepe presale, Chainlink’s growth as an [.] The post Top Crypto Coins to Invest in October 2025: AlphaPepe Presale, Chainlink Growth, and Ethereum Momentum appeared first on Coindoo.

‘Debasement Trade’ to Boost Price, Says JPMorgan

The post ‘Debasement Trade’ to Boost Price, Says JPMorgan appeared com. Banking giant JPMorgan says bitcoin BTC$120,172. 06 could climb to around $165,000 on a volatility-adjusted basis relative to gold, highlighting what the bank sees as significant upside if the so-called debasement trade continues to gain momentum. The Wall Street lenders models suggest that bitcoin would need to rise about 40% from current levels to match the scale of private gold holdings once risk is accounted for. The world’s largest cryptocurrency was trading around $119,000 at publication time. The debasement trade involves buying assets such as gold or bitcoin to hedge against the devaluation of fiat currencies. The bank’s projection comes as retail investors accelerated their embrace of the debasement trade, pouring into both bitcoin and gold exchange-traded funds over the past quarter. Analysts led by Nikolaos Panigirtzoglou noted that flows into these products have surged since late 2024, a trend that picked up ahead of the U. S. presidential election. The analysts framed the trade as a response to long-term inflation concerns, ballooning government deficits, questions about Federal Reserve independence, waning trust in fiat currencies in some emerging markets, and a broader move to diversify away from the U. S. dollar. Cumulative flows into spot bitcoin and gold ETFs have risen sharply, JPMorgan said, with retail buyers driving much of the activity. Bitcoin exchange-traded fund (ETFs) initially outpaced gold earlier in the year, particularly after Liberation Day, but gold ETF inflows have been catching up since August, narrowing the gap. The banks proxy based on open interest shows institutions have been net buyers since 2024, but their momentum has recently lagged retail demand. The steep rise in gold prices over the past month has also bolstered bitcoins relative appeal, as.