SNX Could Be Poised for Breakout After Trendline Rebound As Synthetix Prepares Q4 2025 Ethereum Perpetual DEX

**Why Does Market-Cap Movement Matter for Sentiment?**

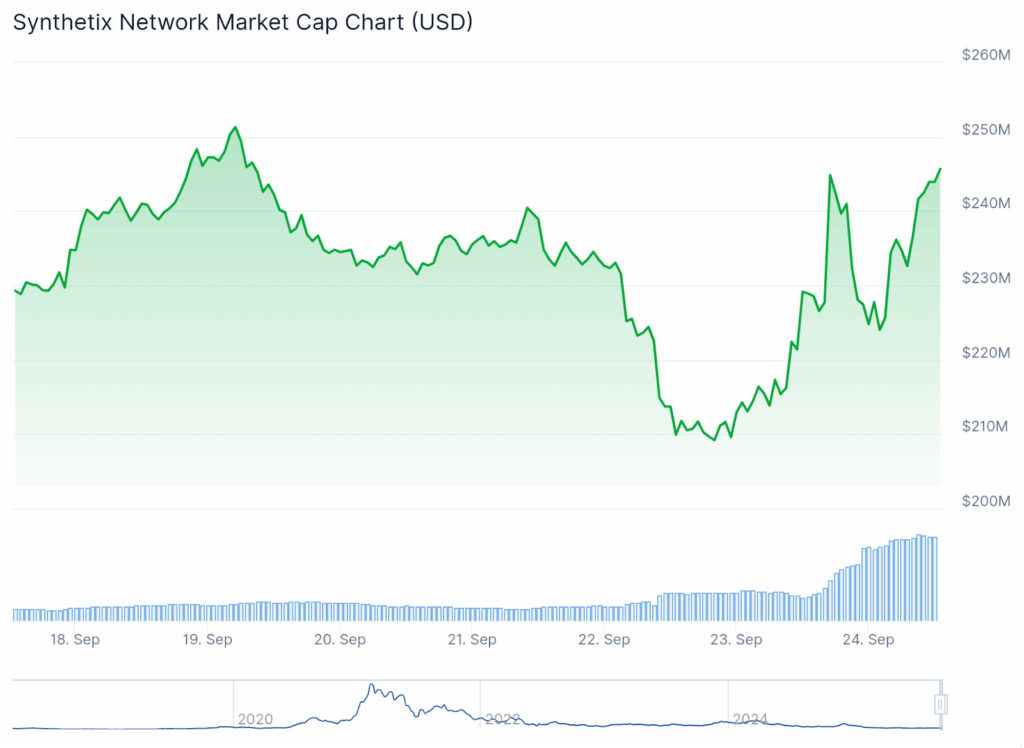

SNX market capitalization fell to roughly $205 million on September 22, 2025, before recovering to above $240 million in a classic V-shaped rebound. This swift recovery in market cap, coupled with steady volume increases throughout September, signals renewed investor confidence rather than mere low-liquidity noise. Such market-cap movements are crucial as they reflect the collective sentiment and trust investors have in the asset.

—

**When Will Synthetix Launch the Ethereum Perpetual DEX and What Features Matter?**

Synthetix has scheduled the launch of its first perpetual decentralized exchange (DEX) on the Ethereum mainnet for Q4 2025. To kick off the launch, a $1 million trading competition is set for October, drawing significant trader attention.

Key features announced for the new Ethereum perpetual DEX include:

– **Gasless Trading:** Reducing transaction costs to improve user experience.

– **Zero Settlement Fees:** Encouraging high trading volumes without extra costs.

– **Multi-Collateral Margin Support:** Supporting assets such as sUSDe, wstETH, and cbBTC, allowing for diversified margin options.

These features aim to make trading more accessible, affordable, and flexible for users.

—

**Technical Breakout Levels and Comparative Data**

Traders are watching two primary scenarios for SNX:

1. A breakout above the 50-day Simple Moving Average (SMA) for a potential continuation trend.

2. A failure to break above the SMA, leading to a revisit of the ascending trendline support.

Below is a compact reference table for quick comparison of critical technical levels:

| Level | Value | Significance |

|———————|——-|————————————-|

| Ascending trendline | $0.62 | Primary support since mid-June 2025 |

| 9-day EMA | $0.672| Short-term momentum indicator |

| 50-day SMA | $0.681| Key resistance for breakout validation|

| Recent high | $0.729| Immediate upside target after reversal|

—

**How Can Traders Approach SNX Ahead of the DEX Launch?**

Traders should implement strong risk management strategies around the $0.62 ascending trendline support and monitor volume closely during any breakout above the 50-day SMA.

– **Short-term Setups:** Momentum buys can be considered above $0.68 with tight stop losses placed below the 9-day EMA to minimize downside risk.

– **Range Trading:** Traders who prefer a conservative approach might wait for a confirmed daily close above the 50-day SMA before entering positions.

Careful observation of these technical levels and volume patterns will be key to navigating SNX’s price action ahead of the highly anticipated DEX launch.

—

**Secure and Fast Transactions**

Diversify your investments with a wide range of coins available across various platforms. Join now to experience:

– The easiest way to invest in crypto

– Secure, fast transactions

– Exciting opportunities like the upcoming Synthetix launch

Don’t wait to get started — click now and discover the advantages of modern crypto investing!

https://bitcoinethereumnews.com/ethereum/snx-could-be-poised-for-breakout-after-trendline-rebound-as-synthetix-prepares-q4-2025-ethereum-perpetual-dex/?utm_source=rss&utm_medium=rss&utm_campaign=snx-could-be-poised-for-breakout-after-trendline-rebound-as-synthetix-prepares-q4-2025-ethereum-perpetual-dex