The post Low Cap Cryptos Whales Are Accumulating Ahead of December appeared com. November is known as “Moonvember” in the crypto world, a period when coins historically see upward movement. In 2025, however, global uncertainty and high interest rates are keeping market rebounds modest. Despite this, some coins are recovering, and investors are increasingly focusing on projects with strong fundamentals rather than just hype. Early-stage, low-cap coins priced under $1 are quietly gaining traction. These projects stand out for their innovative technology and dedicated development teams. For those seeking the best meme coins to buy this month, these presale projects are attracting attention, having successfully raised funds while introducing unique concepts and solutions to the market. Bitcoin Hyper: A High-Performance Layer 2 Built for Real Utility A major Bitcoin whale recently poured $500,000 into Bitcoin Hyper, signaling bold confidence even as the broader crypto market struggles. The move isn’t surprising given the project’s momentum: Bitcoin Hyper combines Bitcoin’s ironclad security and privacy with Solana-grade speed and scalability and has already raised over $27 million during its presale, setting a new benchmark for Layer 2 adoption. Source Cryptonews YouTube Channel On-chain data reveals that these large transactions, including the recent whale investment, reflect growing conviction among investors. Bitcoin Hyper directly tackles Bitcoin’s longstanding limitations, slow transactions, high fees, and network congestion by introducing a high-speed execution layer built to handle modern blockchain demands. Unlike typical meme coins, Bitcoin Hyper provides a full suite of features: wallets, explorers, bridges, staking, and DeFi functionality, enabling users to interact with Bitcoin in ways previously impossible. Developers gain from Rust and Anchor compatibility, clear documentation, and transparent APIs, making it a platform designed for innovation as much as for adoption. Approximately 20% of raised funds are earmarked for marketing and 10% for exchange listings, illustrating a methodical approach to growth and awareness. As market volatility persists, capital.

Institutional Money Flows Into Solana and XRP ETFs as Bitcoin Bleeds

The post Institutional Money Flows Into Solana and XRP ETFs as Bitcocom. AltcoinsBitcoin The crypto market has spent the past week in defensive mode, but traditional finance seems to be playing a very different game. Key Takeaways: Solana and XRP ETFs keep attracting institutional inflows despite the wider crypto downturn. XRP’s ETF launch has already become the strongest of the year across all markets. More XRP ETFs are about to go live, signaling expanding Wall Street demand rather than fading interest. Even as Bitcoin continues to drag the entire sector lower, two assets are attracting steady Wall Street attention and it has nothing to do with hype cycles or social sentiment. Solana and XRP have quickly emerged as favorites in the ETF arena, drawing institutional capital on nearly every trading day since launch. A Rally That Isn’t Coming From Price Action What makes the trend striking is that it’s forming during a downturn. Under normal market behavior, ETFs slow when traders retreat. Instead, the Solana ETF has continued to gather new money day after day. Data compiled from Farside Investors shows that Bitwise’s SOL fund took in another $12 million on November 14. That’s not a one-off weekly inflows have now climbed to $46 million, and the products have yet to see a single day of outflows since hitting the market three weeks ago. It’s a pattern that suggests institutions aren’t treating Solana as a speculative bet, but as a sector exposure worth accumulating into weakness. XRP Steals the Spotlight Then there’s XRP and this is where the story becomes explosive. Canary’s XRP ETF didn’t just launch well; it set a record. The first day brought $245 million in net inflows, and the second day almost mirrored it at $243 million, supported by $58. 5 million in trading volume. For perspective, analysts expected between $17 million and $34 million on.

Rapid USDC Mints on Ethereum May Herald Rise in Tokenized Gold Inflows

The post Rapid USDC Mints com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Multiple $250 million USDC mints on Ethereum highlight a surge in stablecoin activity, with the network’s stablecoin supply expanding 65. 5 times since January 2020, outpacing Ethereum’s market cap growth and underscoring its role in on-chain liquidity. COINOTAG recommends • Professional traders group 💎 Join a professional trading community Work with senior traders, research‑backed setups, and risk‑first frameworks. 👉 Join the group → COINOTAG recommends • Professional traders group 📊 Transparent performance, real process Spot strategies with documented months of triple‑digit runs during strong trends; futures plans use defined R: R and sizing. 👉 Get access → COINOTAG recommends • Professional traders group 🧭 Research → Plan → Execute Daily levels, watchlists, and post‑trade reviews to build consistency. 👉 Join now → COINOTAG recommends • Professional traders group 🛡️ Risk comes first Sizing methods, invalidation rules, and R‑multiples baked into every plan. 👉 Start today → COINOTAG recommends • Professional traders group 🧠 Learn the “why” behind each trade Live breakdowns, playbooks, and framework‑first education. 👉 Join the group → COINOTAG recommends • Professional traders group 🚀 Insider • APEX •.

Jane’s Next Door: Your Go-To Caterers for Halifax Celebrations

HALIFAX, NOVA SCOTIA, 2025-11-15 /EPR Network/ From intimate gatherings to grand festivities, Jane’s Next Door continues to make waves in the local culinary [read full press release.].

AlwaysBeSmile Empowers Independent Authors Worldwide with the Release of The eBook Publisher’s Handbook, a Complete Guide to Modern Digital Publishing

Bangladeshi author and musician AlwaysBeSmile (MD Abdul Ahad Shanto) announces the official release of his new educational title, The eBook Publisher’s Handbook. Designed for aspiring authors and indie publishers, the book provides practical, step-by-step guidance on eBook creation, distribution, and author identity verification. Available globally (excluding Amazon), it simplifies digital publishing for first-time [PR. com].

Dongguan Komikaya Electronics Drives Global Industry Advancement with Innovative Cable Solutions

DONGGUAN, China, 2025-11-15 /EPR Network/ Dongguan Komikaya Electronics, a leading wire and cable manufacturer with over a decade of industry expertise, continues to [read full press release.].

Strategy Inc. Continues Bitcoin Accumulation, Refutes Sale Rumors

The post Strategy Inc. Continues Bitcoin Accumulation, Refutes Sale Rumors appeared com. Key Points: Michael Saylor affirms Bitcoin buying, dismissing sale rumors. Strategy Inc. holds approximately 641, 692 BTC. Bitcoin investment advised with a four-year horizon. Michael Saylor, Executive Chairman of Strategy Inc., dispelled rumors of Bitcoin sales, affirming ongoing acquisitions. Public records show the company holds approximately 641, 692 Bitcoins as of November 2023. Saylor’s stance reinforces Strategy Inc.’s long-term Bitcoin strategy amidst market volatility, potentially influencing investor confidence and impacting Bitcoin’s perceived stability in fluctuating markets. Saylor Confirms 641, 692 BTC Holdings Amid Market Volatility Michael Saylor, Chairman of Strategy Inc., reaffirmed the company’s stance on Bitcoin, declaring ongoing acquisitions contrary to public rumors about selling holdings. The public dashboards confirmed the company’s Bitcoin holdings at approximately 641, 692 BTC. Saylor emphasized the importance of a long-term perspective when investing in Bitcoin, highlighting its natural volatility. He publicly reassured investors that Strategy Inc. remains committed to its Bitcoin strategy: “If you choose to invest in Bitcoin, you need to have a holding perspective of over four years, as volatility is the norm.” Market reaction was immediate, as Saylor’s statement mitigated potential investor concerns about major sell-offs. His declaration on public platforms reinforced Strategy Inc.’s role in the broader Bitcoin landscape, even as Strategy weakens, yet still trades at a premium to Bitcoin holdings. Bitcoin Price Dips 0. 91% as Strategy Inc. Stays the Course Did you know? Strategy Inc. has consistently held its Bitcoin assets even through significant market downturns, supporting its long-term investment philosophy. Bitcoin’s current price stands at $96,097. 76 with a market cap of $1. 92 trillion, demonstrating a 0. 91% decrease over the last 24 hours, according to CoinMarketCap. Its 90-day performance shows an 18. 5% decline, reflecting volatility trends that Strategy Inc. has historically withstood. Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 17: 06 UTC on November 15, 2025.

Stem cells from body fat may repair spinal fractures

A team at Osaka Metropolitan University found that stem cells from fat tissue can repair breaks similar to those common in people with the bone-weakening disease osteoporosis.

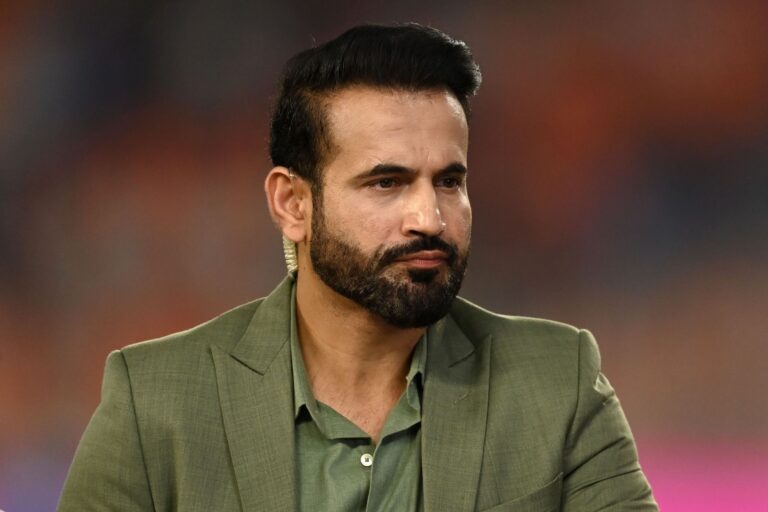

“Him not being in KKR came as a massive surprise” – Irfan Pathan questions star player’s release ahead of IPL 2026 Auction

Former India cricketer Irfan Pathan questioned the release of star all-rounder Andre Russell ahead of the IPL 2026 auction.

Sen. Sheldon Whitehouse’s ‘Priorities’ Mocked As He Plays American Climate Hero at COP30 in Brazil

The COP30 climate summit in Brazil has brought with it the usual irony and hypocrisy that we see at these “we need to save the planet from people like us” meetings:.