India Unveils Sovereign Stablecoin Framework to Challenge Dollar Dominance

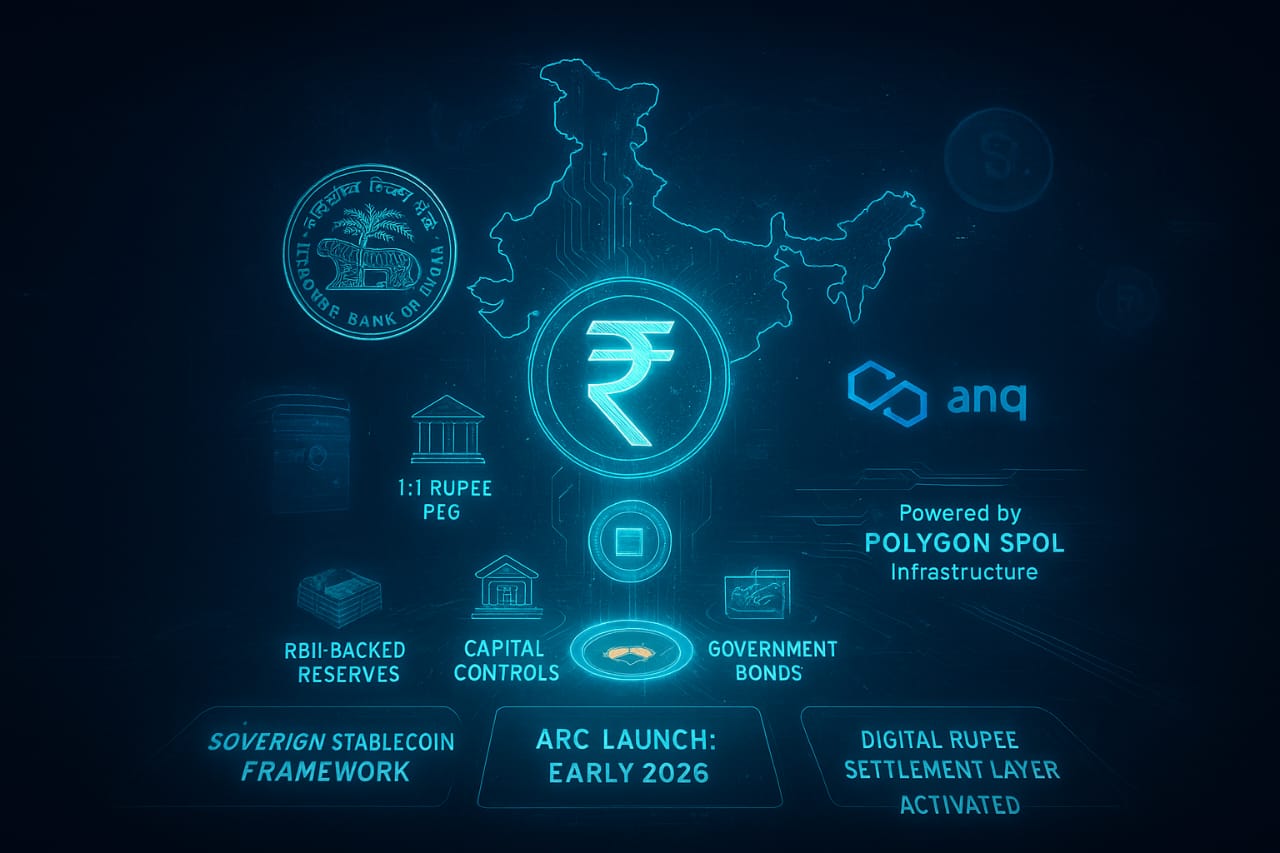

India is stepping into the global stablecoin race with a landmark move. The country is preparing to launch its first sovereign digital currency token, the Asset Reserve Certificate (ARC), a fully rupee-backed stablecoin aimed at tightening capital controls and reducing reliance on the U. S. dollar. The rollout is scheduled for early 2026, setting the stage for one of the world’s largest economies to enter the regulated stablecoin arena with state support. The initiative signals India’s intent to reshape the digital payments market with domestic infrastructure, offering a government-backed alternative to dominant players like USDT and USDC. A National Stablecoin Backed 1: 1 by the Indian Rupee According to early government disclosures, ARC will maintain a strict 1: 1 peg to the Indian rupee, supported by a basket of liquid reserves. These reserves include cash, bank deposits, and government bonds, ensuring that the token stays directly tied to India’s monetary base. The Reserve Bank of India (RBI) is expected to play a central role in managing the backing, placing ARC among the first sovereign stablecoins with formal regulatory support rather than private issuance. This structure positions ARC as a safer and more transparent alternative for domestic and cross-border transactions. Authorities say the stablecoin’s purpose extends beyond innovation. One of its primary goals is to curb capital outflows, which typically flow into dollar-denominated stablecoins during periods of market uncertainty. By providing a regulated in-country option, India aims to reduce dependence on offshore tokens that sit outside domestic oversight. Partnership With Polygon and Anq Signals a Web3-Ready Infrastructure The ARC initiative is being built in collaboration with leading blockchain players. Polygon, one of India’s most influential Web3 ecosystems, and Anq, a rising fintech settlement provider, will contribute the technical backbone for the stablecoin’s on-chain operations. The network is expected to run across major scalable rails, including upcoming Polygon OL infrastructure. This allows ARC to integrate seamlessly with existing decentralized finance (DeFi) tools, enterprise payment layers, and future digital commerce platforms. The collaboration underscores the government’s strategy: pair traditional financial safeguards with modern blockchain architecture. Bringing these entities together offers India a hybrid model, regulatory reliability matched with modular, high-speed Web3 rails. A Strategic Move Against Global Stablecoin Giants India’s ARC launch directly places the country in competition with international stablecoin issuers. USDT and USDC collectively command over $140 billion in circulation and dominate crypto settlements worldwide. However, these tokens are controlled by private issuers outside Indian jurisdiction and typically backed by U. S. Treasury assets. Analysts say ARC could shift that dynamic, especially in domestic markets where the government seeks stronger oversight. A sovereign stablecoin backed by RBI reserves offers an added layer of trust, security, and legal compliance that offshore options cannot guarantee. The move also opens the door for India to build its own digital settlement highways rather than relying on U. S.-centric structures. By deploying ARC across both retail and institutional layers, India could strengthen its financial sovereignty in the Web3 economy. A Bridge Between Traditional Finance and On-Chain Settlement The Indian government views ARC not just as a token but as a new foundation for digital finance. If implemented at scale, ARC could support: Faster cross-border settlements for businesses Regulated on-chain payment flows Tokenization of assets under compliant rails Real-time audits and programmable transactions Integration with India’s existing digital public infrastructure (DPI) Industry experts say the token is likely to become a bridge between legacy banking systems and decentralized applications, allowing Web3 platforms to tap into regulated liquidity without routing through foreign stablecoins. This would be a major shift for Indian fintech, which already handles one of the world’s largest digital payment volumes through systems like UPI. A Controlled Response to Rising Dollar Outflows The launch also comes amid rising concerns about the volume of Indian capital flowing into dollar-backed assets. Offshore stablecoins have become a convenient instrument for residents and businesses seeking exposure to USD or crypto assets outside the formal economy. ARC’s design is intended to counter that trend. By providing a government-regulated, rupee-backed token, India gains more visibility and control over capital movements while giving users a compliant option for on-chain activity. The token is expected to become the preferred settlement layer for: Indian exchanges Domestic institutions Regulated fintech platforms Merchants integrating blockchain payments Web3 developers deploying INR-based services Officials believe the stablecoin can help reinforce monetary stability as the digital asset ecosystem expands. Early Reactions Highlight Global Significance The announcement quickly drew attention across the crypto sector. Analysts pointed out that India, as the world’s most populous country and one of the fastest-growing digital economies, could set a major precedent for stablecoin adoption. Industry observers also noted that India’s entry into sovereign stablecoins could influence other emerging markets facing similar challenges, high remittance fees, dollar reliance, and unregulated crypto flows. If successful, ARC could become a case study in how large nations transition from traditional financial systems to blockchain-based infrastructure without ceding control to foreign assets. India’s rollout plan remains structured and methodical. The ARC stablecoin is scheduled to fully launch in early 2026, giving regulators, partner networks, and developers enough time to set up compliance rails, custodial safeguards, and scalable deployment environments. By pacing the rollout, India aims to avoid the pitfalls seen in unregulated stablecoin ecosystems. The objective is to deliver a transparent, compliant, and globally interoperable token that fits neatly into existing financial rules. A New Digital Chapter for India’s Financial System With ARC, India is not merely adopting blockchain payments but reshaping how sovereign money moves on-chain. The project blends regulation with innovation, giving businesses and developers a native tool for digital transactions that is both secure and scalable. The stablecoin stands to influence domestic payments, cross-border settlement, fintech development, and India’s strategic positioning in global digital economics. If the rollout succeeds, India could establish one of the world’s most advanced regulated stablecoin infrastructures, turning the rupee into a competitive digital asset and reducing long-term reliance on the U. S. dollar. Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

https://themerkle.com/india-unveils-sovereign-stablecoin-framework-to-challenge-dollar-dominance/