European Session Buying Lifts Bitcoin Cash to $491.80 After Breaking $487 Resistance

European Session Buying Lifts Bitcoin Cash to $491.80 After Breaking $487 Resistance

Updated Nov 5, 2025, 10:25 p.m. | Published Nov 5, 2025, 10:20 p.m.

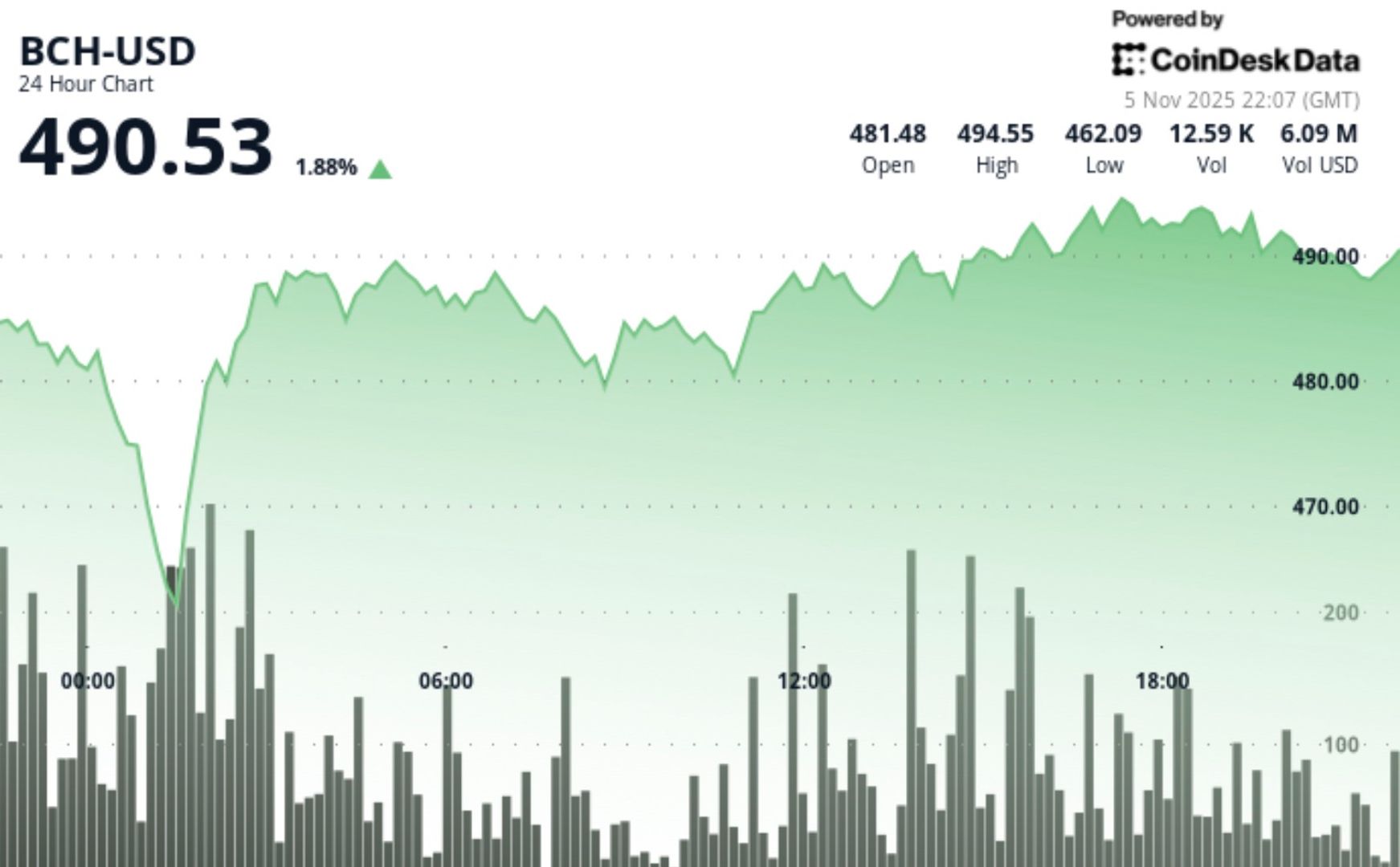

During the European session, sustained buying lifted Bitcoin Cash (BCH) above the $487 resistance level, sending the price up 3.3% to $491.80. Volume surged to 33,795 units on November 4 at 21:00 UTC, a 78% increase above the 24-hour average of 13,478 units.

BCH set higher lows at $462.67, $474.27, and $479.03, demonstrating an ascending trend. Resistance formed near $495, including a session high of $495.30, while support levels were identified at $490, $487, and $479.03.

Technical Analysis Highlights

- Price moved from $476.10 to $491.80, an increase of 3.3%.

- Intraday trading range measured $33.36.

- Higher lows recorded at $462.67, $474.27, and $479.03.

- Breakout above $487.00 occurred during the European session with sustained buying interest.

- Price peaked at $495.30, then pulled back $3.20 to $490.14 before recovering to $492.99.

- Multiple attempts to breach the $495.00 resistance took place between 16:00 and 17:00 UTC on November 5.

- Volume peaked at 33,795 units, a 78% surge compared to the 24-hour average of 13,478 units.

- A 0.65% pullback from session highs was followed by a recovery above $491.00.

Chart Patterns Explained

The data points to a clear ascending trend characterized by multiple higher lows. Buyers consistently stepped in at progressively higher price levels, pushing BCH through the $487 resistance on increased volume. A minor dip was quickly absorbed, maintaining the bullish momentum and confirming the breakout.

Support and Resistance Levels

- Support: $490.00 (psychological level tested during a 60-minute correction), $487.00 (breakout zone), and $479.03 (higher low).

- Resistance: $495.00 zone, marked by several rejections; $495.30 session high.

Targets and Risk Management

- Immediate upside target: $495.30, with potential to break above $500.00.

- Invalidation level: Maintaining above $487.00 is crucial to preserve the bullish structure.

Context: The risk/reward setup favors a continuation of the upward trend with a strong volatility reflected by a 7.0% daily range.

Note: All timestamps are in UTC.

Disclaimer: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Inside Zcash: Encrypted Money at Planetary Scale

By CoinDesk Research | Nov 3, 2025 | Commissioned by Gen Zcash

Zcash has evolved in 2025 from a niche privacy technology into a fully functioning encrypted-money network. Shielded adoption surged, with 20-25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

The Zashi wallet has made shielded transfers the default, pushing privacy from an optional feature to a standard practice. Project Tachyon, led by Sean Bowe, aims to significantly increase throughput to thousands of private transactions per second.

Zcash has surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.