Changpeng Zhao Dismisses Peter Schiff’s Gold-Backed Crypto Plan

**Changpeng Zhao Criticizes Peter Schiff’s Tokenized Gold Plan, Calls It a “Digital Promise” Rather Than True Digital Gold**

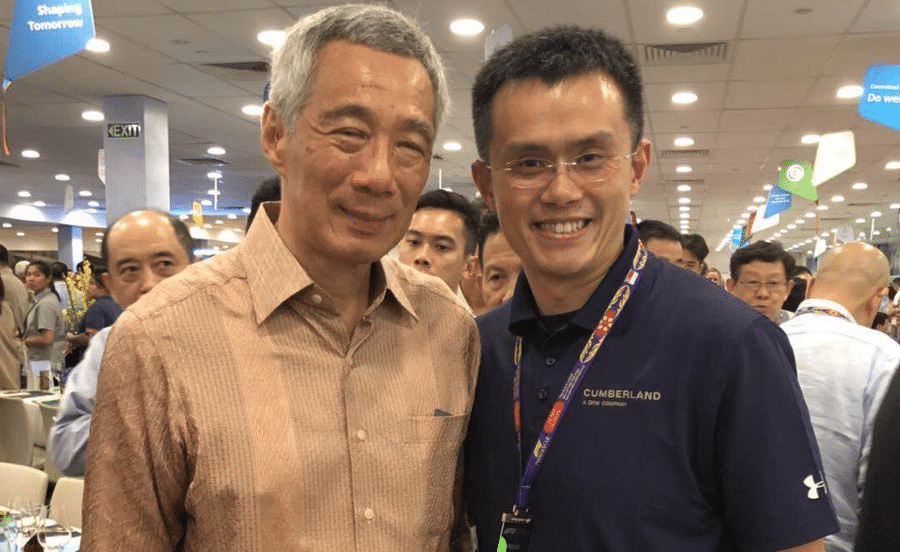

Changpeng Zhao, former CEO of Binance, has publicly criticized Peter Schiff’s plan to launch a tokenized gold product, arguing that it cannot be considered a genuine digital equivalent of gold. Zhao emphasized that tokenized gold depends on centralized entities to hold and redeem the underlying physical gold, making it more of a digital promise rather than true ownership on the blockchain.

### Tokenized Gold: An IOU Backed by Trust in Centralized Custodians

While tokenized gold exists on the blockchain, Zhao points out that it still requires trust in third-party custodians responsible for safeguarding and redeeming the physical gold backing the tokens. He explained, “It’s tokenizing that you trust some third party will give you gold at some later date.”

Zhao warns that this arrangement introduces risks, including management changes or crises within the custodial entity, which could compromise the promise to deliver gold. This reliance on central intermediaries, he argues, contradicts one of the foundational principles of blockchain technology: decentralization.

### Clash with Crypto’s Core Philosophy

Zhao’s critique highlights the fundamental flaw in tokenized gold systems—the dependence on centralized custodians undermines the goal of eliminating intermediaries in financial transactions. In his view, true blockchain assets should not require trust in external parties.

“Tokenized gold is not the same as on-chain gold, and they should not be confused,” Zhao stressed, underscoring that tokenized gold is essentially an IOU that lacks the trustless ownership model championed by cryptocurrencies like Bitcoin.

### Peter Schiff’s Vision for Tokenized Gold

Peter Schiff, a well-known gold advocate and Bitcoin skeptic, recently announced plans to offer tokenized gold through his platform, SchiffGold. Schiff argues that gold remains the superior asset for maintaining purchasing power over time and believes tokenized gold can fulfill many of Bitcoin’s promises.

Schiff claims that his tokenized gold product will enable faster and cheaper transfers compared to Bitcoin, while allowing users to buy, securely store, transfer ownership, or redeem tokens for physical gold held in vaults.

He envisions tokenized gold as a viable rival to Bitcoin as both a means of payment and a store of value—an outlook met with skepticism by Zhao due to its centralized structure.

### Bitcoin’s Market Capitalization Outlook

Despite their differing views on tokenized gold, Zhao shared his perspective on Bitcoin’s market potential. Acknowledging the significant gap between gold’s market capitalization—estimated at $28.5 trillion—and Bitcoin’s $2.18 trillion, Zhao confidently predicted that Bitcoin would eventually surpass gold.

He cites Bitcoin’s finite supply, currently at approximately 19.93 million BTC, as a driving factor behind this anticipated growth in market value.

### Conclusion

Changpeng Zhao’s critique of Peter Schiff’s tokenized gold initiative centers on the key issue of trust and centralization. While Schiff promotes tokenized gold as a digitally efficient way to leverage the value of physical gold, Zhao insists that only truly decentralized assets like Bitcoin align with the fundamental principles of blockchain technology.

As blockchain continues to evolve, the debate over the legitimacy and value of tokenized assets versus native digital currencies remains a critical conversation within the crypto community.

https://coincentral.com/changpeng-zhao-dismisses-peter-schiffs-gold-backed-crypto-plan/