JRs online reservation systems, long operated separately by different regional companies, will be linked together for the first time in an effort to eliminate the inconvenience faced by passengers when booking tickets across multiple areas.

Category: technology

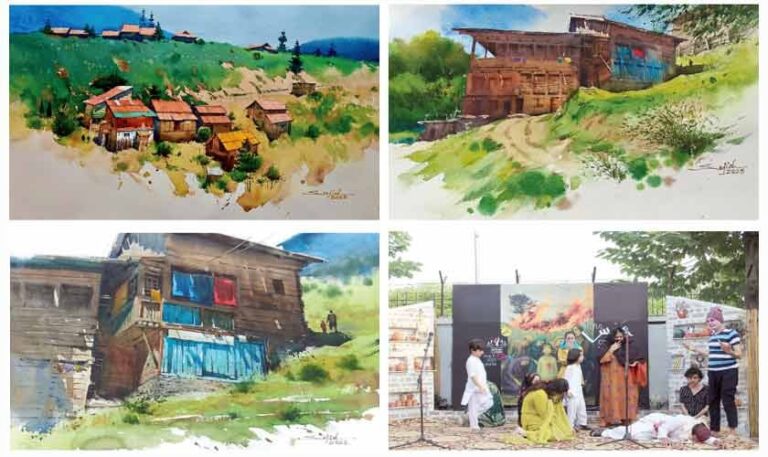

An active autumn

P Peshawar is an ancient city steeped in history, culture and diversity a vibrant hub for literary and cultural activities. Nestled at the crossroads of Central Asia and the Indian subcontinent, Peshawar has long been a melting pot of civilisations, from the Gandharan era to the Mughal.

Chinese rocket debris or meteor? Fireball over India explained

A rare fireball was seen lighting up the skies over Delhi, Gurugram, and parts of Rajasthan early on Saturday.

Naval Ravikant Net Worth in 2025 – Angel Investor

Key Takeaways Naval Ravikant is an Indian-American angel investor, entrepreneur, and leader who is known for his involvement with tech and blockchain startups. He has . Read more.

Trump’s new H-1B visa rule causes chaos at US airports

The United States has been thrown into a tizzy after President Donald Trump raised the H-1B visa fee to $100,000 (88 lakh).

Buy a TV with these specs and you won’t have to worry about upgrading it anytime soon

The article discusses how to choose a television that balances essential features with longevity, recommending 4K over 8K for practical upgrades while emphasizing the importance of resolution based on screen size.

Mumbai News: Special NIA Court Orders Release Of 59-Year-Old Businessman’s Flat Attached Over Tenant’s Alleged ISIS Links

“Once the property is leased on rent, the landlord is least concerned with what activities which are going on within the four walls of the rented premises,” the special NIA court has held while granting the relief to a 59-year-old businessman from Pune, whose flat was attached by NIA as it was used by one of the suspects having alleged links with ISIS.

Grok 4 Fast arrives as cheaper alternative to xAI’s Grok-4

Elon Musk’s artificial intelligence (AI) company, xAI, has unveiled a new model called Grok 4 Fast. The innovative system is a more affordable version of the existing Grok 4.

Grok 4 Fast arrives as cheaper alternative to xAI’s Grok-4

Elon Musk’s artificial intelligence (AI) company, xAI, has unveiled a new model called Grok 4 Fast. The innovative system is a more affordable version of the existing Grok 4.

How IT body Nasscom reacted to Trump’s $100,000 H-1B visa-fee

Nasscom, a major player in the Indian tech industry, is evaluating the potential impact of US President Donald Trump’s proclamation to impose an annual fee of $100,000 (around 88 lakh) on H-1B visas.