If you ever wanted to win a bar bet about a world record, you probably know about the Guinness book for World Records. Did you know, though, that there are …read more

Category: technology

Crypto Market Live: Bitcoin (BTC) Poised for Major Volatility as Price Targets $120,000 This Week

The post Crypto Market Live: Bitcoin price remains the center of attention as it consolidates near the $110,000 mark, hinting at a possible push toward $120,000 amid renewed investor optimism and strong inflows. Ethereum (ETH) price.

Ripple’s XRP ETF Misses Another Deadline: Are They Facing Rejection?

The post Ripple’s XRP ETF Misses Another Deadline: Are They Facing Rejection? appeared first in the U. S. has been delayed. The SEC paused reviews because of a government shutdown. This has pushed back filings from firms such as Grayscale, Bitwise, WisdomTree, Franklin Templeton, 21Shares, CoinShares, and Canary Capital. The pause is only temporary. It does not mean the ETFs were rejected. Institutional.

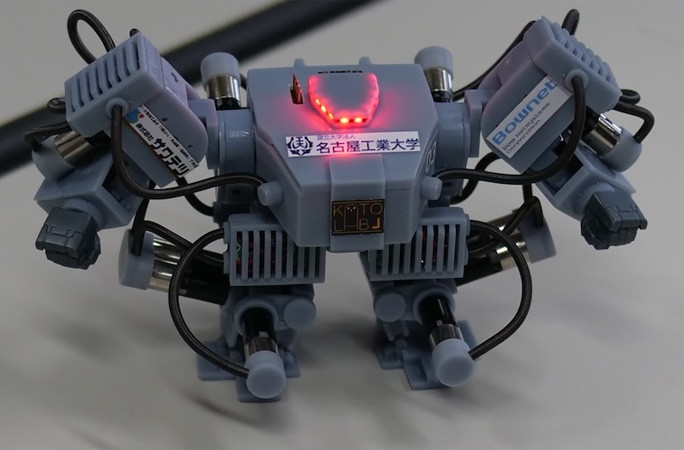

How China Trains Your Robot Dog

Humanoid robots have been getting a lot of buzz this year. But quadrupeds — the mechanical “dogs” — are emerging as the true proving ground for embodied artificial intelligence.

Flare Audio Sonic Lens review: A five-millimeter experiment in over-engineering

They promise clearer, richer sound from your AirPods Pro — but what you actually get is a tiny piece of plastic and a whole lot of anxiety.Sonic Lens by Flare AudioAirPods Pro sound really good. Unsurprisingly, though, Apple generally knows how to make products that do what they say on the box.For example, I have AirPods Pro 2. And, while I still think that my AirPods Max are better for making phone calls, I use my AirPods Pro 2 for almost all other listening. Continue Reading on AppleInsider | Discuss on our Forums

Top Crypto to Buy Now: MoonBull ($MOBU) Skyrockets Ahead With 9,256% ROI While XRP and Ethereum Hold Strong

Are you ready to grab the next crypto rocket before it skyrockets? Investors and enthusiasts are constantly on the hunt [.] The post Top Crypto to Buy Now: MoonBull (OBU) Skyrockets Ahead With 9, 256% ROI While XRP and Ethereum Hold Strong appeared first on Coindoo.

What is ‘ghost tapping?’ New scheme targeting tap-to-pay users

The Better Business Bureau is warning tap-to-pay users of a new scheme that could make simple transactions costly.

Raven Software Reveals They’ll Be Adding a Highly Requested Feature to Call of Duty: Warzone in 2026

Map rotations will be coming to the game, at long last! The post Raven Software Reveals They’ll Be Adding a Highly Requested Feature to Call of Duty: Warzone in 2026 appeared first on Games Fuze.

Ripple Completes $1.25 Billion Hidden Road Acquisition, Launches Prime Brokerage Service

TLDR Ripple completed its $1. 25 billion acquisition of Hidden Road and rebranded it as Ripple Prime, becoming the first crypto company to own a multi-asset prime broker Ripple Prime serves over 300 institutional clients with more than $3 trillion cleared across markets including digital assets, foreign exchange, derivatives, and fixed income The business has tripled [.] The post Ripple Completes $1. 25 Billion Hidden Road Acquisition, Launches Prime Brokerage Service appeared first on CoinCentral.

Ripple CEO Makes a Massive, Unbelievable Statement About XRP

Ripple CEO Brad Garlinghouse has made a powerful statement reaffirming the company’s unwavering commitment to XRP. For context, Ripple announced it has finalized the acquisition of the leading prime brokerage platform, Hidden Road. Visit Website.