When assessing a new crypto project, it’s easy to get swept up in technical jargon and lofty promises. Yet sometimes, [.] The post BlockDAG Raises $430M, Sells Over 27B Coins, Gains 312K Holders, Redefining 2025’s Top Presale Crypto appeared first on Coindoo.

Category: investment

Precious Metals Royalty And Streaming Companies – September 2025 Report

Precious Metals Royalty And Streaming Companies – September 2025 Report

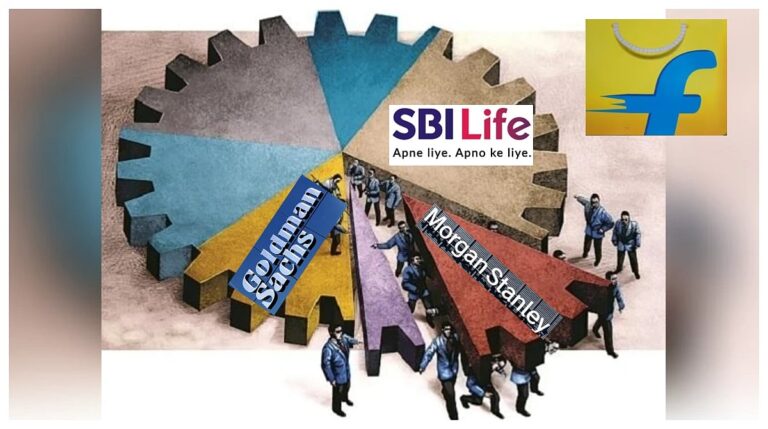

SBI Life, Aditya Birla MF, Morgan Stanley, Goldman Sachs Acquire 6% Stake For ₹998 Crore From Flipkart Investments

Singapore-headquartered Amansa Capital, Nippon India Mutual Fund (MF), ICICI Prudential MF, UTI MF, ICICI Prudential Life Insurance, Ghisallo Capital Management, Societe Generale, and US-based Pathstone are among the entities that have bought stakes in Aditya Birla Lifestyle Brands.

EWS: Singapore Stocks Staging A Strong 2025 Rally, P/E Still Attractive

EWS: Singapore Stocks Staging A Strong 2025 Rally, P/E Still Attractive

Top Crypto Coins to Invest in October 2025: AlphaPepe Presale, Chainlink Growth, and Ethereum Momentum

Analysts are now pointing to three very different plays investors should watch: the viral AlphaPepe presale, Chainlink’s growth as an [.] The post Top Crypto Coins to Invest in October 2025: AlphaPepe Presale, Chainlink Growth, and Ethereum Momentum appeared first on Coindoo.

‘Debasement Trade’ to Boost Price, Says JPMorgan

The post ‘Debasement Trade’ to Boost Price, Says JPMorgan appeared com. Banking giant JPMorgan says bitcoin BTC$120,172. 06 could climb to around $165,000 on a volatility-adjusted basis relative to gold, highlighting what the bank sees as significant upside if the so-called debasement trade continues to gain momentum. The Wall Street lenders models suggest that bitcoin would need to rise about 40% from current levels to match the scale of private gold holdings once risk is accounted for. The world’s largest cryptocurrency was trading around $119,000 at publication time. The debasement trade involves buying assets such as gold or bitcoin to hedge against the devaluation of fiat currencies. The bank’s projection comes as retail investors accelerated their embrace of the debasement trade, pouring into both bitcoin and gold exchange-traded funds over the past quarter. Analysts led by Nikolaos Panigirtzoglou noted that flows into these products have surged since late 2024, a trend that picked up ahead of the U. S. presidential election. The analysts framed the trade as a response to long-term inflation concerns, ballooning government deficits, questions about Federal Reserve independence, waning trust in fiat currencies in some emerging markets, and a broader move to diversify away from the U. S. dollar. Cumulative flows into spot bitcoin and gold ETFs have risen sharply, JPMorgan said, with retail buyers driving much of the activity. Bitcoin exchange-traded fund (ETFs) initially outpaced gold earlier in the year, particularly after Liberation Day, but gold ETF inflows have been catching up since August, narrowing the gap. The banks proxy based on open interest shows institutions have been net buyers since 2024, but their momentum has recently lagged retail demand. The steep rise in gold prices over the past month has also bolstered bitcoins relative appeal, as.

RCB up for sale? Lalit Modi claims on social media

Royal Challengers Bengaluru (RCB), the 2025 Indian Premier League (IPL) champions, are reportedly up for sale.

Nifty and Sensex decline for 3rd straight session on FII outflows, H-1B concerns

Benchmark indices Sensex and Nifty closed lower for the third straight day on Tuesday amid selling in IT and private banks, foreign fund outflows, and concerns over the US H-1B visa fee hike. The Sensex fell 57 points to 82, 102.

Domestic investors pour ₹5.3L crore into equities, surpassing 2024 record

Domestic institutional investors (DIIs) have made a new record in Indian equities this year, surpassing last year’s peak.

Naval Ravikant Net Worth in 2025 – Angel Investor

Key Takeaways Naval Ravikant is an Indian-American angel investor, entrepreneur, and leader who is known for his involvement with tech and blockchain startups. He has . Read more.