Browns’ Shedeur Sanders Finally Got Some NFL Action — Here’s How He Did

Category: general

Broncos’ Sean Payton Gets Steamrolled By Ref And Gets Penalized For His Trouble

Broncos’ Sean Payton Gets Steamrolled By Ref And Gets Penalized For His Trouble

Zcash Surpasses $700; Whale Short Faces $22M Loss

The post Zcash Surpasses $700; Whale Short Faces $22M Loss appeared com. Key Points: Zcash reaches over $700 leading to major short position losses. Significant market impact could arise from whale activities. Potential regulatory considerations due to market volatility. A significant Zcash short position has amassed unrealized losses exceeding $22 million as ZEC reached a new all-time high, stirring market interest. The situation highlights potential risks in leveraged trading, drawing scrutiny from analysts watching for further liquidations or price adjustments. Zcash Whale Faces $22M Loss Amid $700 Price Surge Zcash recently reached a new all-time high exceeding $700, leading to over $22 million in floating losses for a significant short position on Hyperliquid, monitored by AiYi. The major Zcash whale holding over 60, 870 ZEC in short positions, has faced escalating losses as the cryptocurrency climbed, attracting market scrutiny. Community reactions have varied, with notable engagement from on-chain analysis groups. No statements from Zcash developers or Hyperliquid executives have emerged regarding this specific matter, leaving industry observers wary of potential developments. Security and resilience of platform infrastructure remain unaffected. No direct statements or comments found from any industry leaders or official parties regarding the ZEC short position event. Zcash’s Market Impact and Future Regulatory Considerations Did you know? The Zcash price hike to a new all-time high parallels notable short squeeze events from assets like Bitcoin, indicating persistent vulnerabilities in crypto future markets. According to CoinMarketCap, as of November 17, 2025, Zcash trades at $703. 63 with a circulating supply of 16. 31 million, and a market cap of $11. 48 billion. The recent surge marks a 5. 71% rise in 24 hours, showing extensive growth trends over 30, 60, and 90 days. Zcash(ZEC), daily chart, screenshot on CoinMarketCap at 01: 07 UTC on November 17, 2025. If Zcash volatility persists,.

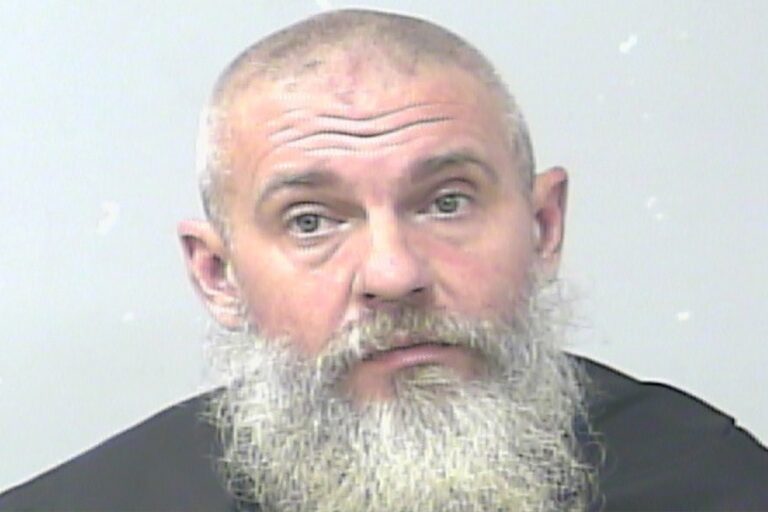

Florida man ‘Farmer Pete’ allegedly opens fire at bar over how many eggs a chicken can lay

The group somehow wound up discussing chickens and egg production, a conversation that quickly escalated when Riera inexplicably grew paranoid.

Japan economy contracts less than expected in September quarter

On an annualised basis, Japan’s third quarter GDP slipped 1. 8%, a softer fall than the 2. 5% expected.

Search underway for missing 15-year-old girl from Deerfield Beach

Broward Sheriff’s Office deputies are seeking the community’s help in finding a missing teen. Fifteen-year-old Zariiyah Hurst vanished on Nov. 8 from the 600 block.

Graham Platner Calls To Stack the Supreme Court and Impeach ‘At Least Two’ Sitting Justices

SKOWHEGAN, Maine-Senate candidate Graham Platner called to stack the Supreme Court and impeach “at least two” of its sitting justices, moves he said should be top priorities for Democrats should they retake the upper chamber next year. The post Graham Platner Calls To Stack the Supreme Court and Impeach ‘At Least Two’ Sitting Justices appeared first on.

Browns’ Shedeur Sanders replaces Dillon Gabriel after possible head injury

The Cleveland Browns were beating the Baltimore Ravens 16-10 at halftime on the power of a pick-six. During the break, Browns quarterback Dillon Gabriel went into concussion protocol, leading the way for Shedeur Sanders’ NFL debut. The Colorado product came onto the field to a rousing applause from the home crowd. Browns fans went nuts [.] The post Browns’ Shedeur Sanders replaces Dillon Gabriel after possible head injury appeared first on ClutchPoints.

Syn Prop & Tech S.A. 2025 Q3 – Results – Earnings Call Presentation

Syn Prop & Tech S.A. 2025 Q3 – Results – Earnings Call Presentation

Longtime CBS Actress and Disney Actor Wed in New Orleans

Keeping it in line with New Orleans tradition, the celebration included a second line street parade, a tarot card reading, and freshly baked beignets. The couple spoke with PEOPLE about their big day. The soap star [.] The post Longtime CBS Actress and Disney Actor Wed in New Orleans appeared first on PopCulture. com.