Vote now: Bay Area News Group girls athlete of the week

Category: general

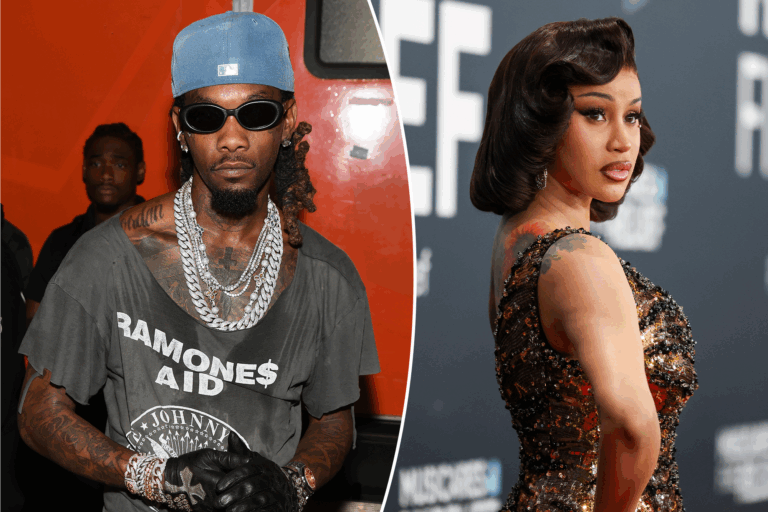

Offset sparks uproar with deleted paternity claim, leaving Cardi B feeling ‘threatened’

Cardi B is speaking out after her estranged husband, Offset, sparked controversy with a comment about her newborn baby with Stefon Diggs. The rapper says she feels harassed and even threatened following the deleted Instagram post. Their ongoing social media drama highlights how private family matters can quickly become public. Watch the full video for.

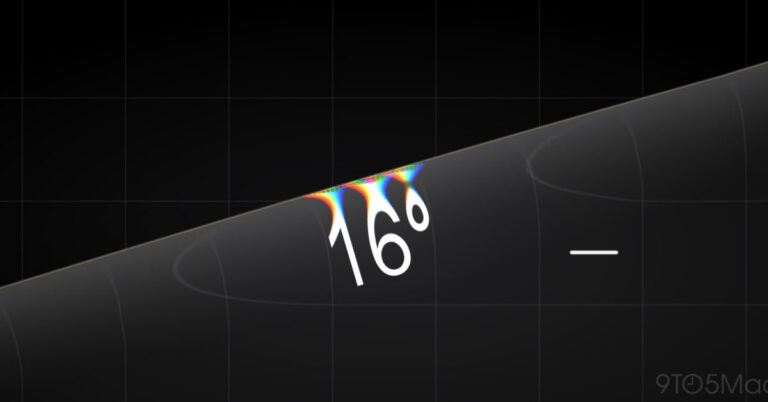

iOS 26.2 adds a cool Liquid Glass effect to the native Level tool [Updated]

Update, November 17, 3: 15 p. m. ET:: Apple has improved the level indicator’s visibility on iOS 26. 2 beta 3. More details below the original story. Apple released iOS 26. 2 beta 2 earlier today, and it continued its system-wide overhaul of the Liquid Glass visual concept with a nice interface update to the Level tool inside the Measure app. Here’s what it looks like. more.

Kevin Stefanski: Shedeur Sanders has done great work, will be better with reps he’s getting

The Browns have not named a starting quarterback for their Week 12 game against the Raiders yet, but there’s a good chance it will be Shedeur Sanders.

Clair Obscur: Expedition 33 received 12 nominations in The Game Awards 2025

Clair Obscur: Expedition 33 had nearly double its closest runners up, which were Ghost of Yotei and Death Stranding 2: On the Beach.

Tim Cook is going to retire at some point, but probably not next year

Macworld Tim Cook celebrated a birthday on November 1. He’s 65 years old. Cook has been Apple’s CEO for 14 years-the longest tenured Apple CEO-and has been with the company for 27 years. That’s a lot of years, which means people (in the media, at least) speculate about when Cook is going to step down from his position. One recent Financial Times report (that you have to pay to read) claims that Apple is developing a succession plan for Cook, who could step down as soon as next year. However, Bloomberg’s Mark Gurman, who is quite familiar with the happenings inside Apple Park and reported on Apple’s future management plans back in October, replied to the FT story saying he didn’t think a change is “imminent.” Gurman suggested the possibility that the report was planted and has previously reported that Hardware Engineering VP John Ternus is being eyed as a possible successor. As I wrote a month ago, Apple is due for a major management shake-up and the spotlight is squarely on John Ternus as Tim Cook’s successor as CEO. But I don’t get the sense anything is imminent as the @FT is claiming. Mark Gurman (@markgurman) November 15, 2025 While retirement seems like something a lot of us look forward to, that doesn’t seem to be the case with Cook. Back in January, Cook appeared on the Table Manners podcast to talk about the role work plays in his life. He had his first job at age 12 delivering newspapers and has always had a job. “My upbringing,” Cook said on the podcast, “a lot of it was centered on work and the belief that hard work was essential for everybody, regardless of your age.” Until these recent reports, it seemed like Cook would be CEO for a few more years, at least. But a lot has changed since that interview, changes that would make a lot of people question whether Cook is doing the right thing. There are also the challenges Apple is facing in a technology sector that is being defined by AI development, an area where Apple is having trouble finding its footing. All of that could make Cook think about stepping down and letting fresh young blood take over. It’s also possible Cook sees the changes as a challenge he’s happy to take on. In any case, there are rumblings (planted or not) of changes ahead with Apple’s top brass. The next time we may get any actual direct insight could be at the 2026 annual shareholders meeting, which is usually held in February. While it’s unlikely Apple will make a management announcement at that time, it will be a way to “gauge the temperature of the room,” so to speak. Apple has enjoyed unprecedented success during Cook’s tenure, with its most recent quarter breaking records for the company and topping $100 billion. Whover takes his place, whenever that may be, will have very big shoes to fill.

Bryce Young shatters Cam Newton record

Bryce Young delivered a career-defining performance on Sunday, breaking one of the most iconic records in Carolina Panthers history. With 448 passing yards in an overtime victory over the Atlanta Falcons, Young surpassed Cam Newton’s previous franchise mark of 432. The performance came at a pivotal time. Young has faced heavy criticism throughout the season, Read more. The post Bryce Young shatters Cam Newton record appeared first on The Comeback: Today’s Top Sports Stories & Reactions.

Jets to bench Justin Fields, start quarterback Tyrod Taylor vs. Ravens

The New York Jets will bench Justin Fields and start quarterback Tyrod Taylor against the Baltimore Ravens, a league source told UPI on Monday.

Big 12 power rankings: Top four stay solid as Arizona soars and a fascinating Territorial Cup comes into focus

The Wildcats are one of the hottest teams in the conference after toppling the No. 25 Bearcats on their home turf.

Queens tenants fight for dignified housing and against the war economy

In La Mesa Verde alone, 859 violations have been filed against the owner, A&E Real Estate – one of New York City’s largest landlords