The post Thai Crypto Exchange Bitkub Weighs Hong Kong IPO: Report appeared com. Thailand-based digital assets exchange Bitkub is mulling an initial public offering (IPO) in Hong Kong, people familiar with the matter told Bloomberg. The exchange may look to raise roughly $200 million from the IPO, possibly next year, the sources said, adding that discussions are ongoing and details could still shift. Bitkub, founded in 2018, previously considered an IPO in Thailand, but the dour performance of the domestic stock market played spoilsport. Thailand’s stock market, one of the worst performers globally this year, has seen an average of over 12% drop in listings in 2025, with the index itself falling 10%. Bitkub is Thailand’s largest cryptocurrency exchange with a total 24-hour trading volume of $60. 75 million, according to data from Coingecko. Hong Kong is actively looking to establish itself as the regional digital asset hub, supported by a clear regulatory roadmap from the Securities and Futures Commission (SFC) and Hong Kong Monetary Authority (HKMA). Source:.

Category: general

Survey reveals why Google’s Wicked Pixel Drop was a total letdown

Survey reveals why Google’s Wicked Pixel Drop was a total letdown

Strike CEO Jack Mallers Says JPMorgan Closed His Accounts Without Warning

Strike CEO Jack Mallers says JPMorgan Chase abruptly terminated his personal bank accounts in September without offering any explanation. The post Strike CEO Jack Mallers Says JPMorgan Closed His Accounts Without Warning appeared first on Cryptonews.

Spotify Wrapped 2025: When It Comes Out And Everything You Need To Know About It

Spotify Wrapped 2025 is expected between late November and early December, with data collection likely ending mid-November, sparking annual online excitement.

Zcash rebound meets whale warning! How THIS challenges the retail surge

The post Zcash rebound meets whale warning! How THIS challenges the retail surge appeared com. Key Takeaways Why did Zcash rebound? A defended trend line and oversold Stoch RSI helped spark its sharp 24-hour recovery. What should ZEC traders track next? Retail activity climbed, but the Long/Short Ratio still favored shorts, keeping momentum uncertain. Zcash recovered sharply after rising more than 10% over the last 24 hours. The bounce interrupted its short-term downtrend and pulled fresh attention from both whales and futures traders. That shift aligned with aggressive repositioning from one of the most active Zcash [ZEC] traders. A major trader flips direction after a heavy loss Lookonchain data showed that trader 0x152e closed a large ZEC long yesterday with an $846,000 loss. The liquidation didn’t slow him down. Shortly after closing the loss, the trader reversed course with a leveraged 5x short on 4, 574. 87 ZEC. That move, paired with his aggressive 20x long on 367. 36 BTC worth $31. 63 million, highlighted how uncertain and divided the market remained around ZEC’s short-term trend. Retail activity surges despite derivatives caution CryptoQuant’s Spot Retail Activity chart showed a sharp rise in retail trading frequency around ZEC’s latest bounce. The dataset reflected heightened participation rather than pure accumulation, but the timing aligned with renewed confidence after the token’s recovery. Derivatives data told a different story. Coinalyze’s Aggregated Long/Short Accounts Ratio hovered near 0. 928, keeping shorts slightly ahead. The chart did not support a 0. 5 surge or a flip toward buyers. That imbalance, paired with rising Spot activity, suggested sentiment was improving on the surface while Futures traders stayed cautious. The reaction marked the trend line’s third successful defense.

Miss Universe Controversy: Fatima Bosch’s Miss Mexico Triumph Rumoured To Be ‘Also Rigged’

A viral TikTok claims Miss Mexico Fatima Bosch’s Miss Universe win was influenced by business and political ties, sparking debate over pageant fairness.

Buecker’s Wings Win Top Pick

The post Buecker’s Wings Wcom. NEW YORK, NEW YORK APRIL 14: (R-L) Paige Bueckers poses for a photo with WNBA Commissioner Cathy Engelbert after being selected with the first overall pick by the Dallas Wings during the 2025 WNBA Draft at The Shed on April 14, 2025 in New York City. NOTE TO USER: User expressly acknowledges and agrees that, by downloading and or using this photograph, User is consenting to the terms and conditions of the Getty Images License Agreement. 1 pick in Sunday’s draft lottery. The franchise drafted guard Paige Bueckers at No. 1 in 2025. Minnesota, which had the second-most chances with 261, received the No. 2 pick. Seattle will select third, followed by Washington at No. 4 and Chicago at No. 5. This year marked the fifth time in lottery history that results matched the exact order of teams’ odds, with prior instances in 2009, 2015, 2016 and 2018. Lottery odds were based on combined records from the 2024 and 2025 seasons among non-playoff teams. Dallas, which finished those two seasons with a league-worst 19-65 record, was guaranteed a top-three pick. The 2026 WNBA Draft is scheduled for April 13 if a CBA is signed on time. Where Each Lottery Team Is At Ahead of the WNBA Draft CHICAGO, ILLINOIS JULY 14: Angel Reese #5 of the Chicago Sky celebrates scoring with teammate Kamilla Cardoso #10 during the first quarter at Wintrust Arena on July 14, 2025 in Chicago, Illinois. NOTE TO USER: User expressly acknowledges and agrees that, by downloading and or using this photograph, User is consenting to the terms and conditions of.

VanEck CEO Warns Quantum Computing Poses Risk to Bitcoin

The post VanEck CEO Warns Quantum Computing Poses Risk to Bitcoin appeared com. Bitcoin’s encryption and privacy could be at risk from quantum computing, but it is still a good investment for now, says Jan van Eck, CEO of investment manager VanEck. “There is something else going on within the Bitcoin community that non-crypto people need to know about,” van Eck told CNBC on Saturday. “The Bitcoin community has been asking itself: Is there enough encryption in Bitcoin? Because quantum computing is coming.” He said that the company believes in Bitcoin (BTC), but it was around before the cryptocurrency launched and “will walk away from Bitcoin if we think the thesis is fundamentally broken.” VanEck is one of the world’s largest crypto asset managers and has multiple Bitcoin products, including a spot Bitcoin exchange-traded fund in the US that has taken in over $1. 2 billion in inflows since launching in early 2024. Jan van Eck speaking on the quantum computing risk. Zcash has soared by over 1, 300% in the past three months as the market has rushed to embrace privacy tokens amid a renewed surge in interest for anonymous crypto transactions. Cryptographer and cypherpunk Adam Back said earlier this month that Bitcoin is unlikely to face a meaningful threat from quantum computing for at least two to four decades. Bear market being priced in Van Eck concluded that the four-year cycle is being priced in right now, recommending dollar-cost averaging into bear markets rather than chasing bull markets. Related: IBM claims major leap toward quantum computers with new chips He said Bitcoin “for sure” needs to be included in investor portfolios due to “mainstream global liquidity.

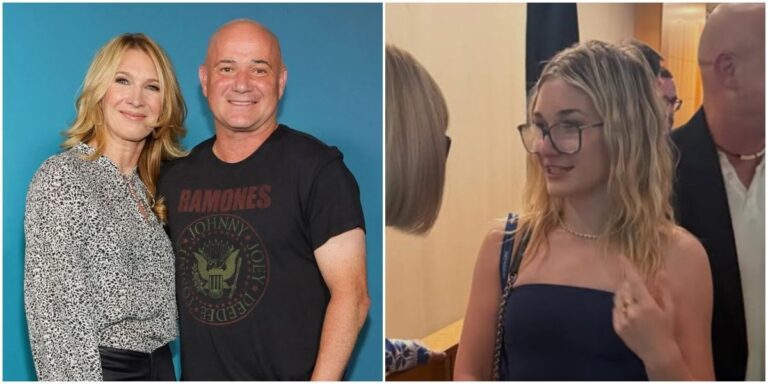

Andre Agassi and Steffi Graf’s daughter Jaz rocks athleisure look to cheer on Las Vegas Raiders with her ‘sister’

Steffi Graf and Andre Agassi’s daughter, Jaz, was in attendance at the Las Vegas Raiders vs the Cleveland Browns at Allegiant Stadium as the NFL entered the 12th week of its regular season.

Cowboys claw back from 14-point deficit to down Eagles

ARLINGTON Brandon Aubrey converted a 42-yard field goal as time expired to lift the Dallas Cowboys to a come-from-behind 24-21 win over the Philadelphia Eagles on Sunday. Aubrey’s kick, the second game-winner of his career, capped a nine-play, 49-yard drive in the final 1: 35. The big play was Dak Prescott’s 24-yard completion to George [.].