Would you care to guess how many of our 21 Congressmen are Republicans, representing that 41% of the population that voted GOP for president in 2024?.

Category: general

Black Ops 7 pre-load details: Everything we know

Black Ops 7 is finally approaching its release date, and the pre-load option has just gone live, but only for PC users on Battle. net.

Ranpak Holdings: Its Catalyst And Valuation Justify Upside

Ranpak Holdings: Its Catalyst And Valuation Justify Upside

Polymarket volume inflated by wash Trading, Columbia study finds

A Columbia University study has found that a significant portion Polymarket’s trading activity was inflated by artificial wash trading, though the platform itself was not directly responsible. A new study by Columbia University researchers has revealed that Polymarket’s trading activity.

‘Female Teacher: Forbidden Sex’ Among Selections as Rotterdam Spotlights Japan’s V-Cinema Movement

The International Film Festival Rotterdam (IFFR) has unveiled its second Focus program for the 55th edition, turning the spotlight on Japan’s V-Cinema the direct-to-video movement that exploded in the late 1980s and profoundly shaped the country’s contemporary film culture. The section, curated by Tom Mes, will run as part of the festival’s 2026 edition [.].

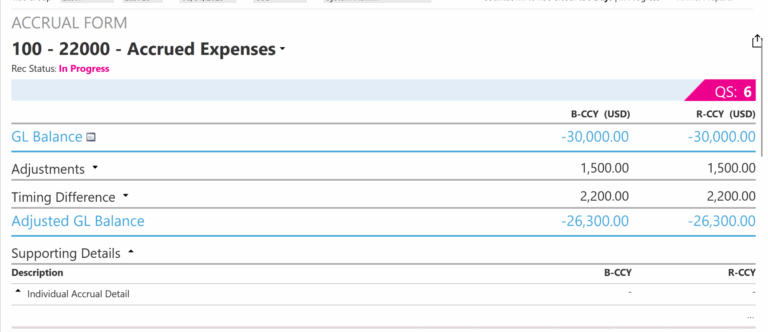

SkyStem Rolls Out Major ART Upgrade with Fresh Modern Reconciliation Experience

SkyStem has announced a substantial update to ART, its well-regarded financial close management solution. The new release introduces.

7000 Or Bust: Why Equity Valuations Can Stay Elevated

7000 Or Bust: Why Equity Valuations Can Stay Elevated

Beep Launches on Sui, Pioneering Agentic Finance Protocol

Beep, the first agentic wallet and finance protocol, launches on Sui, enabling AI-driven DeFi transactions and payments with zero fees globally. (Read More).

K League in 2025-2026 AFC Champions League Match Day 4 Recap

Match Day 4 proved to be one to forget for K League’s AFC Champions League Elite sides, with no goals scored and just one point gained. In AFC Champions League Two, Pohang Steelers had to settle for a.

Abby: Dear old Dad tells relatives he’s been cut off by son

DEAR ABBY: My father and I have had a contentious relationship since I was a teenager. Despite being raised in his house, my values are different from his, and he takes it personally. I left home as soon as I.