AG Pam Bondi Rips Obama Judge for Diverting School Lunch Funds to SNAP

Category: general

Here’s How High Solana Price Could Go If This Support Zone Holds

The post Here’s How High Solana Price Could Go If This Support Zone Holds appeared on BitcoinEthereumNews.com. Key highlights: Solana has dropped right into a key demand zone between $150 and $160 and buyers are finally starting to show some life again. Analysts say if this area holds, Solana might bounce back toward $175–$185, or even retest $200 if momentum picks up. If bulls cannot hold the area, the SOL price might slip towards $130 or lower, which, in a way, makes this a make-or-break moment for SOL. Solana (SOL) price prediction: Can the $150 support zone spark a new rally? Solana has been on a ride lately. After a strong summer rally that took it above $200, the momentum has cooled off fast. The token has been slowly bleeding lower, testing the patience of traders who got used to seeing green candles every week. But after this latest drop, things are starting to get interesting again because Solana has landed right on top of a major demand zone that could decide what happens next. The $150–$160 range isn’t just any random area on the chart. It’s a zone where Solana has seen heavy buying in the past, and right now, the same thing might be happening again. Buyers are slowly coming back for Solana Analyst BitGuru summed it up well in his post earlier this week. He pointed out that the Solana price dropped into a key demand zone after spending weeks consolidating between $175 and $200. BitGuru said that this is where buyers are beginning to show up again. If the price manages to hold between $150 and $160, we could easily see a bounce back toward $175–$185 in the short term After a long consolidation phase $SOL dipped into the major demand zone and is now showing signs of a pullback / reversal attempt. Buyers are slowly stepping in around $150–$160. If price holds…

Thomson Reuters: Staying Neutral As Near-Term Organic Growth May Slow Further

Thomson Reuters: Staying Neutral As Near-Term Organic Growth May Slow Further

Markets Weekly Outlook: Traders Get Impatient For The U.S. Shutdown To End

Markets Weekly Outlook: Traders Get Impatient For The U.S. Shutdown To End

Some states are requiring gun safety lessons in schools that teach kids ‘stop, don’t touch’

Along with stop, drop and roll, some states are teaching students to ‘Stop and don’t touch that gun.’.

Perú implementa medidas adicionales en el estado de emergencia en Lima y Callao

LIMA (AP) El gobierno peruano decretó el viernes medidas adicionales para el estado de emergencia en Lima y la provincia del Callao, las cuales versan sobre control penitenciario, vigilancia digital y coordinación multisectorial para enfrentar la ola de criminalidad. El decreto, publicado en boletín especial en la noche, modifica la norma que había declarado [.].

Corey Day ‘grateful’ for the opportunity to represent HMS in 2026

Corey Day ‘grateful’ for the opportunity to represent HMS in 2026

Bitcoin Valuation Reset: MVRV Slides Into Macro Correction Territory — What This Means

The post Bitcoin Valuation Reset: MVRV Slides Into Macro Correction Territory What This Means appeared com. Bitcoin’s latest market pullback has pushed its MVRV ratio back into a critical zone that has historically been associated with macro correction lows and early-stage recovery setups. The MVRV metric now reflects a valuation reset similar to the conditions that preceded major rebound phases in prior cycles. Why The Reset Reinforces Bitcoin Value Proposition The crypto bearish performance echoes through the Bitcoin community as the Market Value to Realized Value (MVRV) ratio dips into the critical 1. 8 to 2. 0 range, a zone significant for past cycle corrections where BTC found its footing before initiating a recovery. An ambassador and market expert, BitBull, has revealed on X that for those unfamiliar with its significance, the MVRV ratio compares BTC’s current market value to its realized value, which is what investors actually paid for their coins. However, when this ratio dips near 2, it signals that a majority of holders are hovering around their cost basis. At this point, there’s no greed left in the system, just conviction. Historically, this 1. 8 to 2. 0 MVRV range has coincided with major market bottoms in June 2021, November 2022, and April 2025, when the market felt broken, but BTC was quietly resetting. With the MVRV ratio currently re-entering this same critical zone, combined with the massive liquidations observed recently and a palpable sense of panic across the market, the pattern feels eerily familiar. Every time sentiment turns into hopelessness, on-chain data would show a different story of exhaustion, not collapse. BitBull personally views this phase as one of compression, not capitulation, indicating short-term pain but a long-term opportunity. The same market dynamics cycle that previously punished excessive leverage is now washing out the remaining weak hands. BitBull concluded that if history rhymes, this will be the part of the story where the bottom gets written,.

Sauce Gardner delivers heartwarming gifts to young Jets fans devastated by Colts trade

Sauce Gardner has made two young Jets fans convert over to Indianapolis — and he is rewarding them for it.

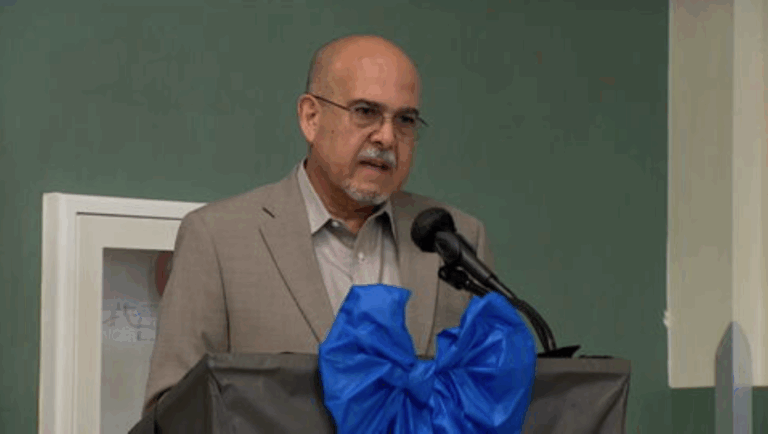

MDCPS unveils new makeover at Dr. Frederica Wilson/Skyway Elementary School in Miami Gardens

A Miami Gardens elementary school got a major makeover. Miami-Dade officials gathered at the Dr. Frederica Wilson/Skyway Elementary School on Friday for a groundbreaking ceremony.