Emmanuel Clase de la Cruz and Luis Leandro Ortiz Ribera, two pitchers with the Cleveland Guardians of Major League Baseball, were indicted Sunday for taking bribes in exchange for throwing rigged pitches.

Category: general

Dreyer and Pellegrino each score 2 goals, San Diego beats Timbers 4-0, advances to conference semis

Anders Dreyer and Amahl Pellegrino scored two goals each to help San Diego FC beat the Portland Timbers 4-0 on Sunday night and win their best-of-3 first-round series in the MLS Cup playoffs. No. 1 seed San Diego plays fourth-seeded Minnesota in the single-game Western Conference semifinals. Pablo Sisniega made his second career playoff start at goalkeeper for the injured CJ dos Santos and had two saves for San Diego.

Denis Puric explains where he picked up the iconic ‘watch it freaks’ slogan: “It was just so catchy”

Veteran striker Denis Puric of Canada and Bosnia utters one of the most memorable lines in combat sports.

UNC Field Hockey Earns No. 1 Overall Seed in 2025 NCAA Tournament

Carolina is once again the No. 1 team in the country entering the NCAA Tournament. The Tar Heels earned the tournament’s No. 1 overall seed Sunday night for the fourth consecutive year. Top seed. Not satisfied. The Heels host the NCAA First & Second Rounds once again. pic. twitter. com/Xer4W9IYtK Carolina Field Hockey (@UNCFieldHockey) November 10, [.] The post UNC Field Hockey Earns No. 1 Overall Seed in 2025 NCAA Tournament appeared first on Chapelboro. com.

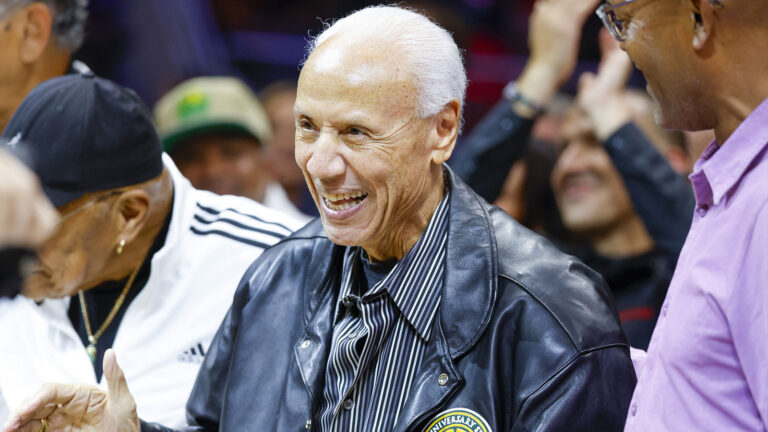

Lenny Wilkens Death: Warriors Coach Steve Kerr honors 9x All-Star’s legacy with wholesome memory after Seattle Supersonics legend’s demise

Lenny Wilkens, a former Seattle SuperSonics great and legendary head coach, passed away on Sunday, Nov. 10, at the age of 88.

Democrat Policies Are Crazy, but Crazy Still Sells (See NYC)

TAS Publisher Melissa McKenzie’s Center of the Democratic Party is not a happy read, but it’s an essential one with a high truth.

College Football Program Fires Head Coach Amid Three-Game Losing Streak

College Football Program Fires Head Coach Amid Three-Game Losing Streak

Lenny Wilkens, Sonics legend, passes away at 88

The basketball community received unfortunate news on Sunday after NBA legend Lenny Wilkens passed away. He was 88 years old. Wilkens’ family announced the sad development but did not immediately disclose the cause of death. Wilkens, a three-time inductee to the Hall of Fame, stands as one of the most respected and influential figures in [.] The post Lenny Wilkens, Sonics legend, passes away at 88 appeared first on ClutchPoints.

Caleb Williams, Ben Johnson Interaction Sparks Rumors of Conflict in Bears’ Locker Room

Chicago Bears QB Caleb Williams and head coach Ben Johnson had a terse interaction Sunday, causing some to read between the lines. The post Caleb Williams, Ben Johnson Interaction Sparks Rumors of Conflict in Bears’ Locker Room appeared first on Heavy Sports.

XRP ETFs Near Breakthrough as Institutional Heavyweights Race Toward Launch

The post XRP ETFs Near Breakthrough as Institutional Heavyweights Race Toward Launch appeared com. XRP ETF launches move closer as DTCC listings and new SEC filings from major issuers suggest trading could begin imminently, signaling a pivotal advancement in integrating digital assets into mainstream institutional markets. XRP ETFs Near Launch as Institutional Momentum Builds Financial institutions are ramping up efforts to bring XRP exchange-traded funds (ETFs) to market, marking [.] Source:.