Euro Area PMIs strengthen in October as manufacturing and services activity expands

Category: finance

MaxLinear Non-GAAP EPS of $0.14 beats by $0.02, revenue of $126.5M beats by $1.84M

MaxLinear Non-GAAP EPS of $0.14 beats by $0.02, revenue of $126.5M beats by $1.84M

$75,000 A Year Is How Much An Hour? and Best Jobs To Give You 75K

Making a yearly income of $75,000 seems like a good deal, but is it really enough? Do you know how much you have and owe at the end of each pay period? Or are you wondering: $75,000 a year is how much an hour? In this article, you will find out how much $75,000 is . Read more.

U.S. Bancorp stock raised to Buy from Hold at Deutsche Bank

U.S. Bancorp stock raised to Buy from Hold at Deutsche Bank

West Pharmaceutical Non-GAAP EPS of $1.96 beats by $0.27, revenue of $804.6M beats by $16.9M

West Pharmaceutical Non-GAAP EPS of $1.96 beats by $0.27, revenue of $804.6M beats by $16.9M

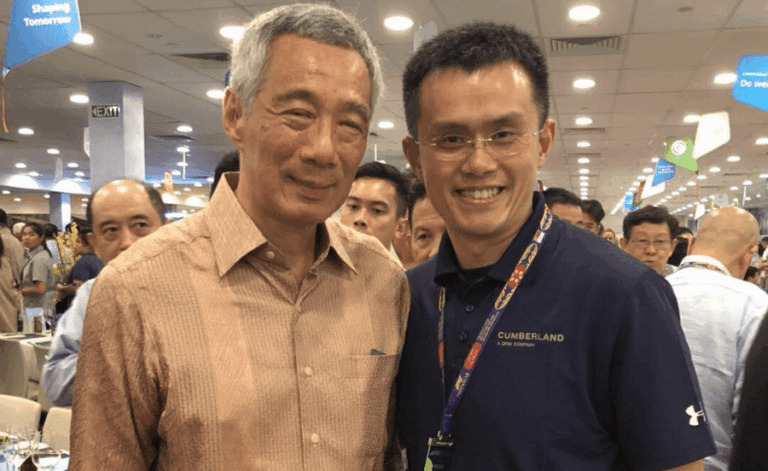

Changpeng Zhao Dismisses Peter Schiff’s Gold-Backed Crypto Plan

TLDR Changpeng Zhao criticized Peter Schiff’s plan to launch a tokenized gold product, stating that it cannot be considered a digital equivalent of gold. Zhao emphasized that tokenized gold relies on centralized entities to hold and redeem the physical gold, making it a digital promise rather than actual ownership. He pointed out that tokenized gold [.] The post Changpeng Zhao Dismisses Peter Schiff’s Gold-Backed Crypto Plan appeared first on CoinCentral.

Cathay General Bancorp raises 2025 loan and deposit growth guidance to 3.5%-5% amid CRE and residential loan expansion

Cathay General Bancorp raises 2025 loan and deposit growth guidance to 3.5%-5% amid CRE and residential loan expansion

Astronics Corporation Announces Third Quarter 2025 Financial Results Conference Call and Webcast

EAST AURORA, N.Y.–(BUSINESS WIRE)–Astronics Corporation (Nasdaq: ATRO) Announces Third Quarter 2025 Financial Results Conference Call and Webcast

Steven Meier to Depart as CIO of NYC Pensions

Steven Meier to Depart as CIO of NYC Pensions

Coinbase Acquires Investment Platform Echo for $375 Million in Cash-and-Stock Deal

The post Coinbase Acquires Investment Platform Echo for $375 Million in Cash-and-Stock Deal appeared first The agreement, completed through a mix of cash and Coinbase stock, strengthens the exchange’s push into blockchain-native capital markets and.