A coalition of business organizations has urged US President Donald Trump to reconsider the recently announced $100,000 fee for H-1B visa applications.

Category: economy

Focus on Bihar as Modi set to unveil Rs 62K cr schemes

Focus on Bihar as Modi set to unveil Rs 62K cr schemes

Dow, S&P 500 manage record closing highs; Nasdaq falls in volatile session

The S&P 500 and Dow achieved record closing highs Friday, navigating a volatile session amid an ongoing government shutdown. Interest rate-cut expectations strengthened, driven by weak economic data, including contracting services employment. Traders now anticipate a Fed rate cut in October as almost certain, with another probable in December, despite concerns about a prolonged shutdown’s impact.

What 100 Articles Taught Me About Money And Life

A journey through India’s past fears, present opportunities, and the future of financial resilience

DBP tightens scrutiny of cash withdrawals

MANILA, Philippines — The Development Bank of the Philippines (DBP) is stepping up safeguards when handling government transactions, vowing closer scrutiny of cash withdrawals as a flood control probe widens. DBP president and chief executive Michael de Jesus said the state-run lender had moved to shore up safeguards at front-line units that handle government transactions,

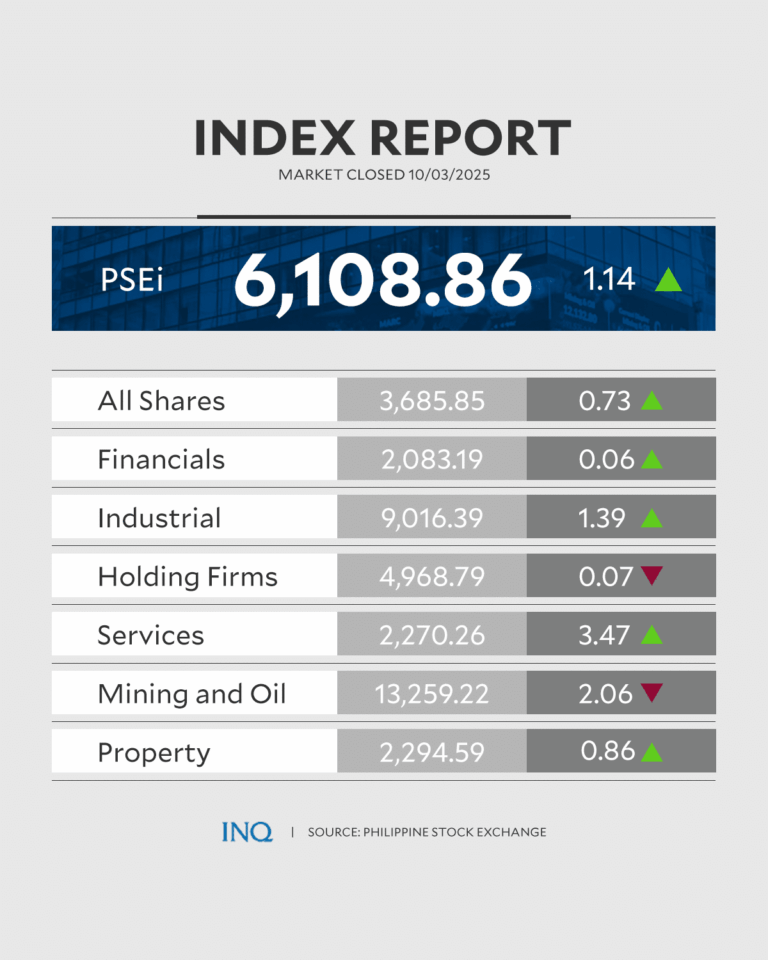

PSEi rises above 6,100 amid buying spree

MANILA, Philippines — The Philippine Stock Exchange Index (PSEi) extended its winning streak to the third consecutive session on Friday. It closed just above the 6,100 mark as investors continued their buying spree. By the closing bell, the benchmark PSEi had rallied by 1.14 percent or 69.1 points to close at 6,108.86. Also, the broader

Zomato’s parent Eternal grants ESOPs worth ₹211 crore

Eternal, the parent company of Zomato, has announced a new round of employee stock options (ESOPs).

Zomato’s parent Eternal grants ESOPs worth ₹211 crore

Eternal, the parent company of Zomato, has announced a new round of employee stock options (ESOPs).

2025 Mahindra Thar launched at ₹10 lakh: Check top features

Mahindra has launched the 2025 Thar (facelift) in India, starting at ₹9.99 lakh (ex-showroom).

‘Debasement Trade’ to Boost Price, Says JPMorgan

The post ‘Debasement Trade’ to Boost Price, Says JPMorgan appeared com. Banking giant JPMorgan says bitcoin BTC$120,172. 06 could climb to around $165,000 on a volatility-adjusted basis relative to gold, highlighting what the bank sees as significant upside if the so-called debasement trade continues to gain momentum. The Wall Street lenders models suggest that bitcoin would need to rise about 40% from current levels to match the scale of private gold holdings once risk is accounted for. The world’s largest cryptocurrency was trading around $119,000 at publication time. The debasement trade involves buying assets such as gold or bitcoin to hedge against the devaluation of fiat currencies. The bank’s projection comes as retail investors accelerated their embrace of the debasement trade, pouring into both bitcoin and gold exchange-traded funds over the past quarter. Analysts led by Nikolaos Panigirtzoglou noted that flows into these products have surged since late 2024, a trend that picked up ahead of the U. S. presidential election. The analysts framed the trade as a response to long-term inflation concerns, ballooning government deficits, questions about Federal Reserve independence, waning trust in fiat currencies in some emerging markets, and a broader move to diversify away from the U. S. dollar. Cumulative flows into spot bitcoin and gold ETFs have risen sharply, JPMorgan said, with retail buyers driving much of the activity. Bitcoin exchange-traded fund (ETFs) initially outpaced gold earlier in the year, particularly after Liberation Day, but gold ETF inflows have been catching up since August, narrowing the gap. The banks proxy based on open interest shows institutions have been net buyers since 2024, but their momentum has recently lagged retail demand. The steep rise in gold prices over the past month has also bolstered bitcoins relative appeal, as.