The post Today’s Wordle #1672 Hints And Answer For Friday, January 16 appeared com. How to solve today’s Wordle. Friday comes at last. For competitive Wordle players, it’s 2XP Friday. Double your points, good or bad, and let the chips fall where they may. Let’s dive right in and solve today’s Wordle! Looking for Thursday’s Wordle? Check out our guide right here. Today’s Bonus Wordle Now that we can create our own custom Wordles, I’m including a bonus Wordle with each daily Wordle guide. These can be 4 to 7 letters long. Hopefully this is a fun extra challenge. Click the link below to play the Wordle I hand-crafted for you. Today’s Bonus Custom Wordle is 7 letters long. Play Puzzles & Games on Forbes The hint: Like a canyon. Again. The clue: This Wordle ends with a vowel. Yesterday’s Custom Wordle Answer: RAVINE How To Solve Today’s Wordle How To Play Wordle Wordle game website displayed on a phone screen is seen in this illustration photo taken in Poland on August 6, 2024. After each guess, the game gives feedback to help you get closer to the answer: Green: The letter is in the word and in the correct spot. Yellow: The letter is in the word, but in the wrong spot. Gray: The letter is not in the word at all. Use these clues to narrow down your guesses. Every day brings a new word, and everyone around the world is trying to solve the same puzzle. Some Wordlers also play Competitive Wordle against friends, family, the Wordle Bot or even against me, your humble narrator. See rules for Competitive Wordle toward the.

Category: cryptocurrency

US Crypto Policy Debate Intensifies as CLARITY Act Support Fractures

The post US Crypto Policy Debate Intensifies as CLARITY Act Support Fractures appeared com. US Crypto Policy Debate Intensifies as CLARITY Act Support Fractures | Bitcoinist. com Sign Up for Our Newsletter! For updates and exclusive offers enter your email. This website uses cookies. By continuing to use this website you are giving consent to cookies being used. Visit our Privacy Center or Cookie Policy. I Agree Source:.

Spokane Imposes Ban on Cryptocurrency ATMs

The post Spokane Imposes Ban com. Key Points: Spokane City Council bans cryptocurrency ATMs, citing fraud concerns. This action represents the first city-level prohibition in the state. Nationwide $5. 6 billion losses reported from ATM scams in 2023. Spokane, Washington, has enacted a complete ban on cryptocurrency ATMs, highlighting growing concerns over scams linked to these machines, according to a new city council ordinance. The ban mirrors an evolving regulatory trend as authorities nationwide react to escalating crypto ATM fraud, impacting market accessibility and consumer protection. Spokane Leads with Landmark Crypto ATM Prohibition Spokane, Washington, now prohibits cryptocurrency ATMs after the City Council unanimously passed Ordinance C36704, citing rising fraud concerns. Paul Dillon, City Council Member, Spokane City Council remarked, “This ordinance will protect vulnerable Spokane residents from scams involving virtual currency kiosks, and I am proud we are the first city in the state to move this legislation forward.” The FBI’s report showing nearly $5. 6 billion in U. S. losses factored into the decision. Detective Tim Schwering of the Spokane Police Department underscored the loss many residents faced, calling it a first step in public protection. The ordinance requires operators to remove ATMs as 80% of the world’s machines are in the U. S. No U. S. states have yet matched Spokane’s action, but discussions are ongoing in other jurisdictions. Spokane bans virtual currency kiosks for public safety. As a result of the ordinance, all cryptocurrency ATMs must be removed from the city, setting a precedent for other municipalities considering similar actions. Coincu analysts see potential shifts in how regulatory frameworks target crypto infrastructure, with emphasis on differences in state vs. federal responses. This could spur modifications to crypto service operations nationally. Bitcoin’s Current Market Trends Amid Regulatory Changes Did you know? Spokane is the first major U. S. city to enact a complete ban on cryptocurrency ATMs, highlighting a.

Only 7 Hours Left to Join this Viral Presale: Why Snorter Token Could be The Next Big Crypto to Skyrocket

Takeaways: Snorter Token is hosting one of the hottest presales this season, driven by increasing interest in its upcoming Telegram-based [.] The post Only 7 Hours Left to Join this Viral Presale: Why Snorter Token Could be The Next Big Crypto to Skyrocket appeared first on Coindoo.

Best Crypto to Buy Now: AlphaPepe Emerges as the Next 100× Opportunity

But beyond the blue-chip coins, retail attention is shifting toward early-stage opportunities projects that combine transparency, innovation, and explosive [.] The post Best Crypto to Buy Now: AlphaPepe Emerges as the Next 100× Opportunity appeared first on Coindoo.

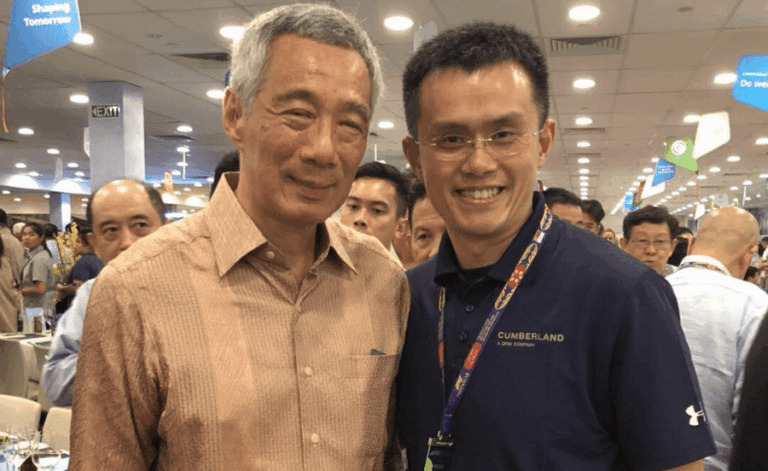

Changpeng Zhao Dismisses Peter Schiff’s Gold-Backed Crypto Plan

TLDR Changpeng Zhao criticized Peter Schiff’s plan to launch a tokenized gold product, stating that it cannot be considered a digital equivalent of gold. Zhao emphasized that tokenized gold relies on centralized entities to hold and redeem the physical gold, making it a digital promise rather than actual ownership. He pointed out that tokenized gold [.] The post Changpeng Zhao Dismisses Peter Schiff’s Gold-Backed Crypto Plan appeared first on CoinCentral.

BlockDAG Raises $430M, Sells Over 27B Coins, Gains 312K Holders, Redefining 2025’s Top Presale Crypto

When assessing a new crypto project, it’s easy to get swept up in technical jargon and lofty promises. Yet sometimes, [.] The post BlockDAG Raises $430M, Sells Over 27B Coins, Gains 312K Holders, Redefining 2025’s Top Presale Crypto appeared first on Coindoo.

Uniswap Faces Crucial Support, Ethereum Slows on Upgrade Delays, While BlockDAG’s $430M Presale Dominates the Market

Uniswap is currently hovering near an important price support zone, drawing the attention of analysts and traders alike. Ethereum, on [.] The post Uniswap Faces Crucial Support, Ethereum Slows on Upgrade Delays, While BlockDAG’s $430M Presale Dominates the Market appeared first on Coindoo.

Bitcoin faces a high-stakes November – CPI shock collides with FOMC

Key Takeaways Is Bitcoin showing signs of a bottom? Bitcoin shorts are being squeezed and spot-led demand is stepping in, but macro uncertainty and sticky inflation keep the trend far from guaranteeThe post Bitcoin faces a high-stakes November CPI shock collides with FOMC appeared first on AMBCrypto.

Bitcoin Market Structure Remains Bullish as High Levels Hold

The post Bitcocom. Key Points: Axel Adler Jr. discusses Bitcoin’s high-level support. Expert insights place focus on levels near $110,000. Market correction viewed as controlled deleveraging. CryptoQuant analyst Axel Adler Jr. discussed Bitcoin’s market maturity, referencing $110K levels amidst controlled deleveraging, according to his statements on X in October 2025. This highlights the market’s stability at high levels, contrasting erroneous $10K support claims, driving investor confidence despite recent volatility at historically elevated price points. Bitcoin’s $110K Support Highlights Market Maturity Recent corrections in Bitcoin’s value are viewed as controlled events rather than a collapse. Spot volumes reached $44 billion and futures $128 billion, with a significant $14 billion open interest drop. Controlled deleveraging keeps the structural market outlook positive, avoiding forced liquidations. “A very mature moment for Bitcoin,” Axel Adler Jr. stated, steering away from outdated narratives about $10K levels. Expert insights reveal a mature market structure supported by high-level price action. Bitcoin’s Resilience and Historical Price Patterns Analyzed Did you know? During the 2020 Covid Crash, Bitcoin experienced a similar market pattern with a sharp decline followed by a robust recovery, eventually reaching new highs. Analysts now see parallel behavior, with current rebounds near historical $100K-$110K levels. Bitcoin’s current price is $108, 422. 46 USD, with a market cap of approximately $2. 16 trillion. Its 24-hour trading volume stands at $85. 84 billion, showcasing a 24. 61% change. Bitcoin’s price dipped by 2. 22% in the last 24 hours, with a further decline over 90 days accounting for 8. 35%, CoinMarketCap reports. Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 05: 55 UTC on October 17, 2025. Experts observe historical trends and current data to assess impact, seeing controlled deleveraging as a stabilizing force in maintaining price resilience above critical levels. DISCLAIMER: The information on this website is.