Bitcoin Mining Stocks May Retreat After $94B Rally as Miners Move About 51,000 BTC to Exchanges

Bitcoin Mining Stocks See Market Cap Decline Following BTC Dip and Miner Outflows

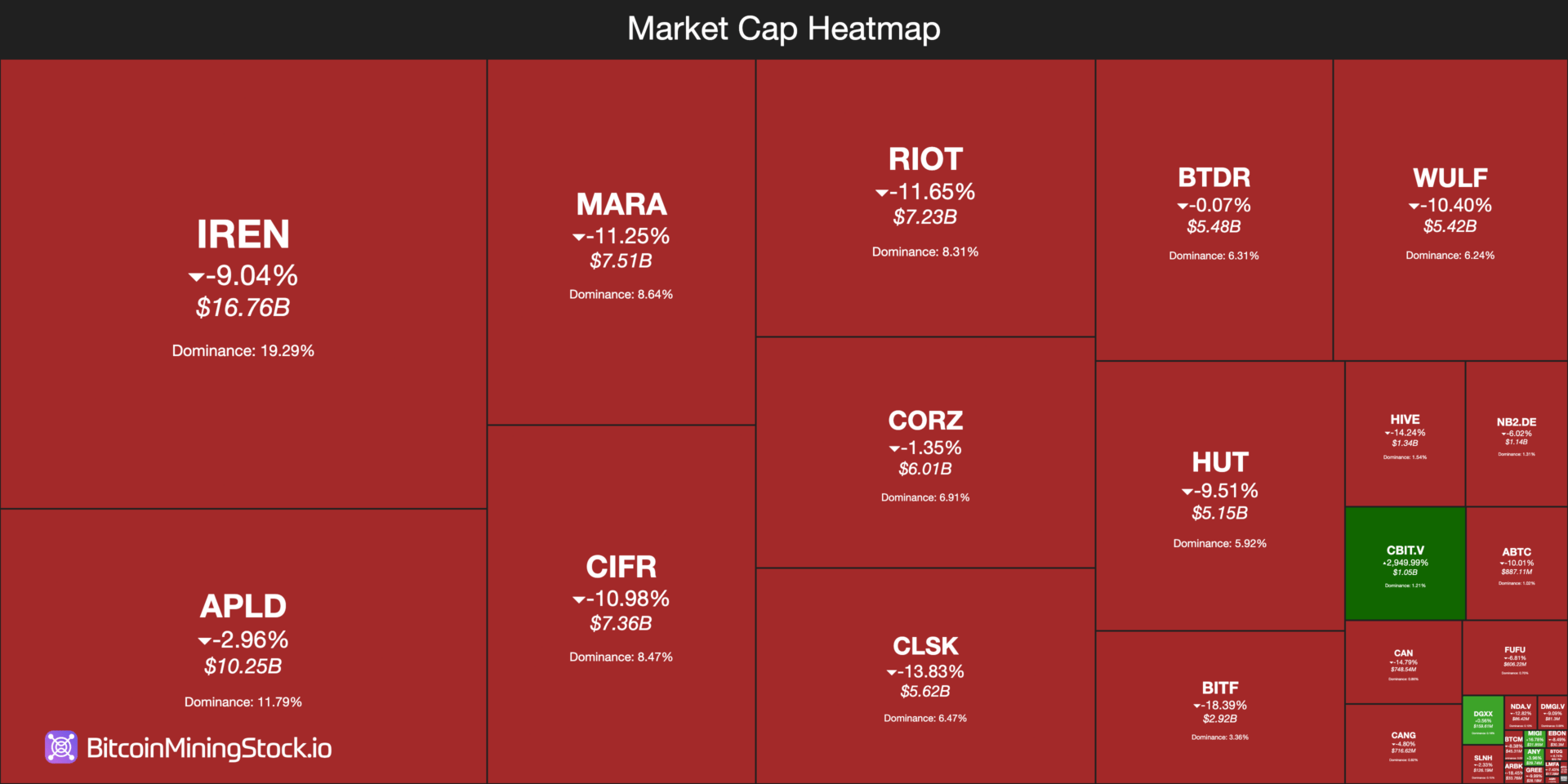

The market capitalization of Bitcoin mining stocks fell from $94 billion to approximately $86.91 billion following a Bitcoin price dip and increased miner outflows. Beginning October 9, miners moved roughly 51,000 BTC to exchanges, intensifying selling pressure on the sector.

Sector Leaders and Market Movements

IREN Limited leads the Bitcoin mining sector with a market cap of $16.76 billion, although its shares declined around 9% to trade near $61.83. Applied Digital Corporation (APLD) holds a market cap of about $10.25 billion with shares easing approximately 3% to trade near $36.64. MARA Holdings (MARA), with a market cap near $7.51 billion, saw shares plunge around 11.25% to about $20.27 amid acquisition activity.

What Are Bitcoin Mining Stocks and Why Did They Fall?

Bitcoin mining stocks represent equity shares in companies operating cryptocurrency mining infrastructure or providing related services. These stocks declined after Bitcoin experienced a sharp price correction below $108,000 combined with elevated miner selling activity. Increased BTC supply on exchanges pressured investor sentiment and market capitalization.

Impact of Recent Bitcoin Price Movements on Mining Stocks

The sector had rallied strongly over the past year, with combined market capitalization growing from approximately $28 billion to a peak of $94 billion. However, the sector remains highly sensitive to Bitcoin price fluctuations.

Bitcoin briefly dropped from highs above $121,000 to lows near $104,000 on some exchanges. Concurrently, miners transferred significant BTC reserves to exchanges, amplifying downward price pressure.

Data from Bitcoin Mining Stock, CoinGecko, and market reports show the sector contracted to about $86.91 billion at the most recent count.

Miner Bitcoin Flows and Their Significance

Starting October 9, miner wallets transferred about 51,000 BTC to exchanges, as reported by Cryptopolitan. These flows often indicate that mining operations are adjusting balance sheets, funding their activities, or taking profits.

While miner selling is not inherently bearish in the long term, the timing alongside Bitcoin’s price downturn reduced market liquidity and contributed to the sector-wide equity selloff.

Just two days before the pullback, Bitcoin mining equities had doubled in value to roughly $94 billion, reflecting robust investor enthusiasm earlier in the rally.

Sector Developments and Corporate Actions

Recent corporate moves had supported positive sentiment prior to the correction. IREN Limited signed multi-year cloud service agreements to deploy Nvidia Blackwell GPUs, signaling expansion into high-performance computing services.

MARA Holdings announced an agreement to acquire a 64% stake in Exaion, a company specializing in operating HPC data centers. These strategic transactions attracted investor attention but could not fully offset the immediate impact of miner flows and the broader cryptocurrency price correction.

Broader Crypto Market Response

The overall cryptocurrency market attempted a recovery after a prior crash that liquidated over $19 billion in positions. On October 10, Bitcoin traded near $121,741 before declining to approximately $104,000 on some exchanges.

By the latest update, Bitcoin traded around $107,938 and Ethereum near $3,870, according to real-time figures from CoinGecko. The total crypto market capitalization stood at about $3.76 trillion, down roughly 2.18% in 24 hours.

The Fear and Greed Index registered a “Fear” reading of 28, reflecting cautious market sentiment.

Policy, Macro, and Liquidity Factors

Several macroeconomic factors coincided with recent market stress. Trade-policy tensions, including public statements about potential tariffs, have created broader pressure on risk assets.

Investors also continue to compare Bitcoin’s liquidity dynamics with other store-of-value assets—for example, the global gold market cap is estimated around $30 trillion. These macro signals can compound the crypto-specific flows from miners and traders, adding complexity to market dynamics.

Frequently Asked Questions

Are Bitcoin mining stocks a safe hedge against Bitcoin price volatility?

Bitcoin mining stocks can offer leveraged exposure to Bitcoin price movements but are not a guaranteed hedge. They involve exposure to operational factors such as hardware cycles, energy costs, and company fundamentals. Historically, mining stocks have shown higher volatility compared to spot Bitcoin.

Why did miners move 51,000 BTC to exchanges?

Miners transfer BTC to exchanges for routine reasons such as covering operational expenses, managing capital expenditures, or rebalancing reserves after price appreciation. The miner flows observed starting October 9 contributed to near-term selling pressure amid a Bitcoin price correction.

Key Takeaways

- Market correction: Bitcoin mining stocks fell by approximately 7.68% following a rapid BTC price pullback from above $121,000.

- Miner flows matter: About 51,000 BTC moved from miner wallets to exchanges starting October 9, increasing supply pressure.

- Company-level variance: IREN, Applied Digital, and MARA led market-cap rankings but experienced varying share price declines linked to sentiment and corporate developments.

Conclusion

Bitcoin mining stocks experienced a sharp retracement as Bitcoin dipped below $108,000 and miners shifted sizable coin reserves to exchanges. Although corporate deals and infrastructure investments—such as Nvidia Blackwell GPU deployments and strategic acquisitions—support long-term sector growth, near-term equity performance remains tightly correlated with Bitcoin price movements and miner balance-sheet activities.

For ongoing coverage, COINOTAG will continue to monitor on-chain miner flows, market capitalization data from Bitcoin Mining Stock, real-time prices from CoinGecko, and sentiment gauges such as the Fear and Greed Index.

Published: 2025-10-17 | Updated: 2025-10-17 | Author: COINOTAG