WIF Surged 5% to $0.497 Before Retreating as Profit-Taking Emerged

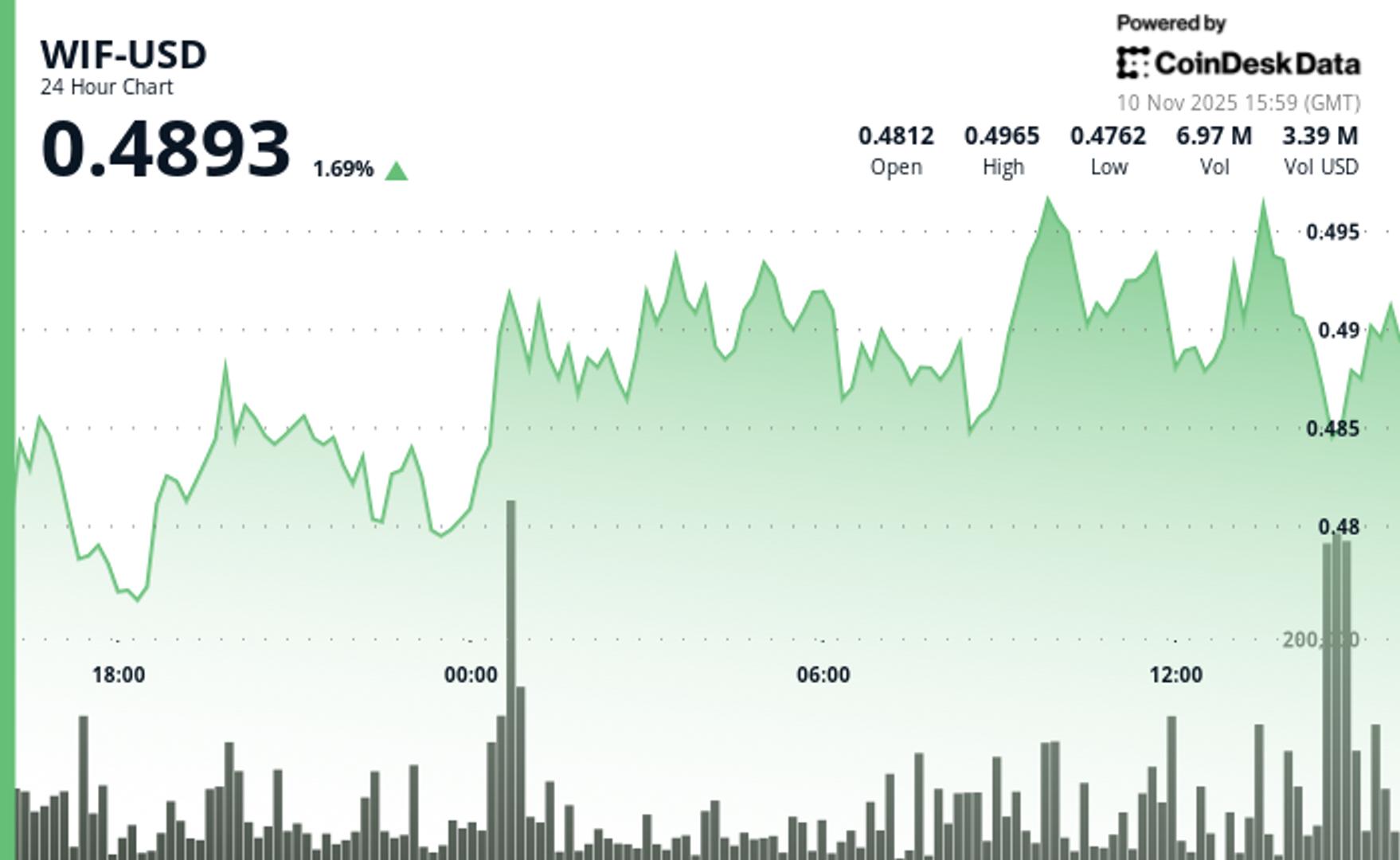

According to CoinDesk Research’s technical analysis data model, dogwifhat (WIF) staged a measured accumulation phase before explosive gains carried the memecoin to session highs near $0.497 during Tuesday trading.

WIF spent most of the 24-hour period consolidating between $0.4754 and $0.4897 before breaking out dramatically in the overnight hours with institutional-level volume. The breakout materialized at November 10, 00:00, when trading volume exploded to 12.51 million shares, marking a 98% surge above the session’s 5.62 million average.

The token decisively cleared the $0.4840 resistance level while holding support at $0.4775, confirming three consecutive higher lows from the session base. The volume spike validated genuine buying interest as WIF advanced through technical resistance levels.

Late-session action turned aggressive as WIF surged from $0.491 to $0.497 at 13:37 before profit-taking emerged. Volume spiked to 437,000 shares at 14:02 as selling pressure forced a retreat to $0.491 by session close. The sharp reversal at $0.497 suggests institutional players took profits at technical resistance.

**Consolidation vs. Breakout: What Traders Should Watch**

With fundamental catalysts absent, technical levels dominated price action as WIF navigated between defined support and resistance zones. The overnight breakout on genuine volume confirms institutional participation, while the $0.497 rejection establishes clear resistance for future tests.

The $0.485–$0.490 support zone becomes critical for bulls defending the breakout structure. Gap conditions through 14:13 indicate incomplete price discovery at highs, positioning WIF for either continuation above $0.497 or a deeper pullback depending on volume follow-through.

**Key Technical Levels Signal Retest Potential for WIF**

– **Primary resistance:** $0.497 (session high with profit-taking)

– **Secondary resistance:** $0.4897 (consolidation range ceiling)

– **Critical support zone:** $0.485–$0.490 (breakout retest level)

– **Base support:** $0.4775 (validated during volume surge)

**Volume Analysis**

– Breakout confirmation: 12.51 million shares (98% above 24-hour average)

– Resistance test volume: 437,000 shares at $0.497 peak

– Volume contraction to 1.37 million shares signals momentum pause at highs

**Chart Patterns**

– Tight consolidation within $0.4754–$0.4897 range (5.0% spread)

– Three consecutive higher lows establishing bullish base structure

– Gap conditions near session highs indicate incomplete price discovery

**Targets & Risk/Reward**

– Immediate focus: $0.485–$0.490 support retest for continuation setup

– Breakout target: Clear break above $0.497 opens extended upside

– Stop loss: Below $0.4775 invalidates bullish breakout structure

—

**CoinDesk 5 Index (CD5) Posts Solid Gains Despite Late-Session Consolidation**

The CoinDesk 5 Index climbed from $1,783.62 to $1,848.07 for a $64.45 gain (3.61%) with momentum reaching $1,850.33 before sellers emerged at resistance.

https://www.coindesk.com/markets/2025/11/10/wif-surged-5-to-usd0-497-before-retreating-as-profit-taking-emerged