America’s officially running out of pennies — and it’s costing retailers millions

**The Sudden End of the Penny: How Trump’s Decision is Impacting Commerce Nationwide**

President Donald Trump’s decision earlier this year to stop producing the penny is starting to have real implications for the nation’s commerce. Merchants across multiple regions have run out of pennies and are struggling to make exact change. Meanwhile, banks are unable to order fresh pennies and have begun rationing the coins for their customers.

One convenience store chain, Sheetz, got so desperate for pennies that it briefly ran a promotion offering a free soda to customers who brought in 100 pennies. Another retailer revealed that the shortage could cost it millions this year, as it has to round down transactions to avoid legal complications.

“It’s a chunk of change,” said Dylan Jeon, senior director of government relations with the National Retail Federation.

### Penny Shortage Worsens During Holiday Season

The penny problem began in late summer and is only worsening as the country enters the busy holiday shopping season. Despite the shortage, not a single retailer or bank has called for the penny to remain in circulation. Pennies tend to be heavy in bulk and are often used only to give customers change.

However, the abrupt decision to discontinue the penny came with no guidance from the federal government, leaving many stores pleading with customers to pay with exact change.

“We have been advocating abolition of the penny for 30 years. But this is not the way we wanted it to go,” said Jeff Lenard of the National Association of Convenience Stores.

### Why the Penny Was Discontinued

On February 9, Trump announced the United States would no longer mint pennies, citing their high production costs. Both the penny and the nickel have been more expensive to produce than their face value for several years, despite efforts by the U.S. Mint to cut costs.

According to the Mint’s 2024 annual report, it costs 3.7 cents to produce a penny and 13.8 cents to make a nickel.

“Let’s rip the waste out of our great nation’s budget, even if it’s a penny at a time,” Trump wrote on Truth Social.

In May, the Treasury Department placed its final order for copper-zinc planchets, the blank metal disks used to mint coins. By June, the last pennies were minted, and by August, these pennies were distributed to banks and armored vehicle service companies.

### Banks Struggle to Meet Penny Demand

Troy Richards, president and chief operations officer at Louisiana-based Guaranty Bank & Trust Co., revealed the struggle banks face to maintain penny supplies.

“We got an email announcement from the Federal Reserve that penny shipments would be curtailed. Little did we know that those shipments were already over for us,” Richards said.

The $1,800 worth of pennies the bank had on hand lasted just two weeks. Now, their branches keep small amounts of pennies only for customers cashing checks.

### Why Pennies Are Rarely Circulated

In 2024, the U.S. Mint produced 3.23 billion pennies, more than double the next most minted coin—the quarter. However, pennies are rarely recirculated. Most Americans store them in jars or use them for decoration, requiring the Mint to create a large volume annually.

The Treasury Department expects to save $56 million by halting penny production. Despite the losses on pennies, the Mint remains profitable overall by producing other coins and appealing numismatic products. In 2024, the Mint earned $182 million in seigniorage—the profit from minting coins.

### Distribution Challenges Exacerbate the Shortage

Besides hoarding habits, distribution logistics are also a hurdle. The Federal Reserve handles coin distribution through about 170 coin terminals operated mainly by armored carrier companies, where banks can deposit and withdraw coins.

Currently, roughly one-third of these terminals no longer accept penny deposits or fulfill penny withdrawals. Bank lobbyists warn this worsens the shortage since pennies surplus in one region can’t easily be sent to areas experiencing shortages.

“A Federal Reserve spokeswoman said, “As a result of the U.S. Department of the Treasury’s decision to end production of the penny, coin distribution locations accepting penny deposits and fulfilling orders will vary over time as (penny) inventory is depleted.”

### Legal Issues in Rounding Transactions

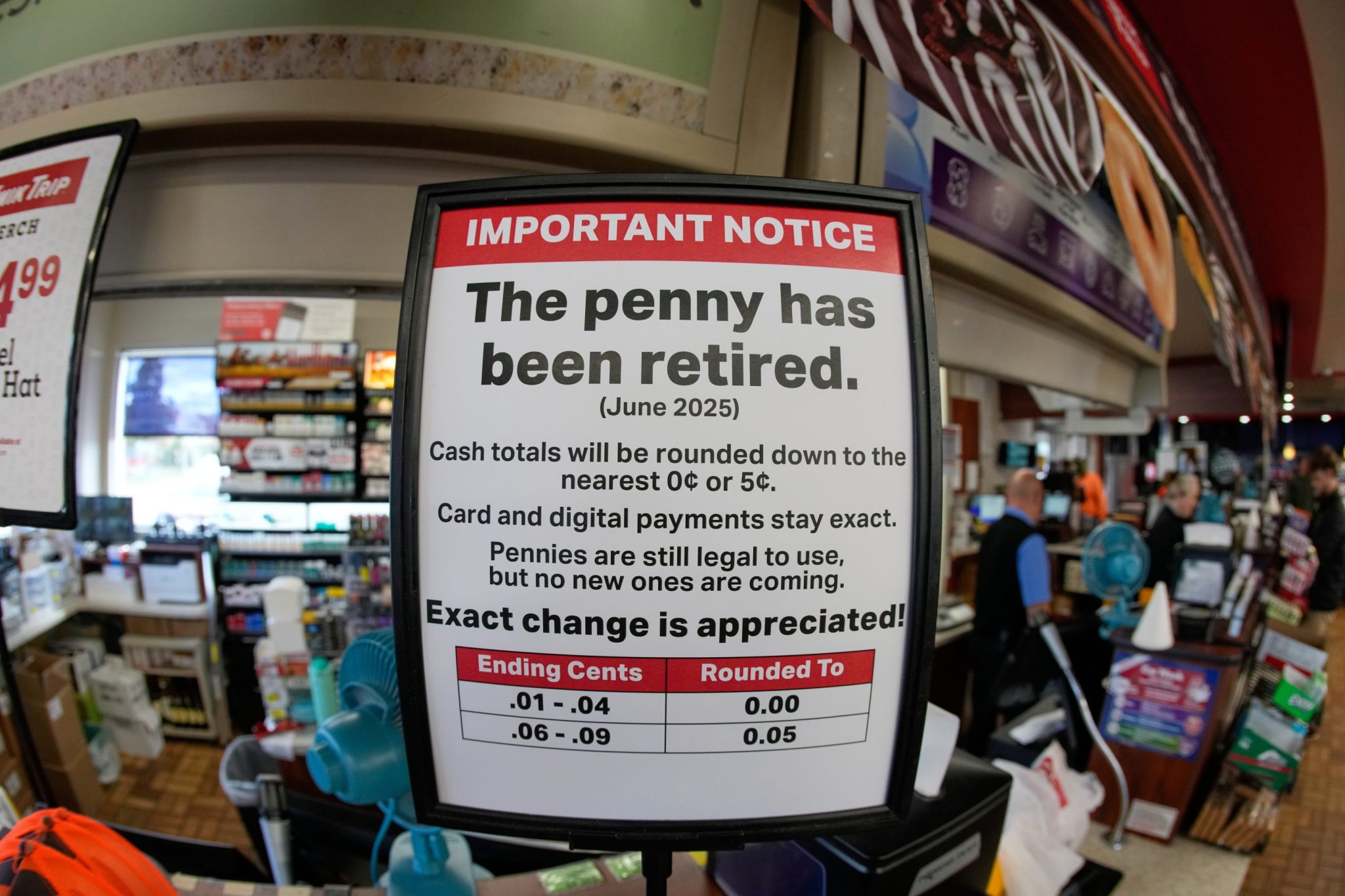

The penny shortage also creates legal complications for retailers. In some states and cities, rounding up transactions to the nearest nickel or dime is illegal due to laws that ensure cash and card customers pay the same amount.

To avoid lawsuits, many retailers are rounding transactions down. While losing a few cents per transaction might seem trivial, it adds up over tens of thousands of transactions.

Kwik Trip, a Midwest convenience store chain, reports it has been rounding down every cash transaction to the nearest nickel, costing the company roughly $3 million this year.

Some retailers have even started encouraging customers to donate their change to local or affiliated charities at checkout to minimize penny use.

### Proposed Legislation and Government Response

A bill currently pending in Congress—the Common Cents Act—calls for cash transactions to be rounded to the nearest nickel, either up or down. While businesses generally support this, consumers might face higher costs if transactions are rounded up.

The Treasury Department did not provide a comment on whether any guidance exists for retailers or banks regarding the penny shortage or related circulation issues.

### How Other Countries Handled Coin Transitions

The United States is not the first country to phase out small denomination coins. However, in all these cases, governments phased out such coins gradually over several years, often with clear guidance to the public and businesses.

For example:

– Canada announced in 2012 it would eliminate its one-cent coin, transitioning out of one-cent cash transactions starting in 2013, and continues redeeming pennies even a decade later.

– The United Kingdom’s decimalization process, converting farthings and shillings to a 100-pence-to-a-pound system, spanned the 1960s and early 1970s.

In contrast, the U.S. removed the penny abruptly, without Congressional action or regulatory guidance, leaving retailers and banks struggling to adapt.

### Industry Calls for Federal Guidance

Both the retail and banking sectors—rarely aligned on policy issues—are now united in demanding federal guidance or legislation to address the challenges stemming from the penny shortage.

“We don’t want the penny back. We just want some sort of clarity from the federal government on what to do, as this issue is only going to get worse,” said Jeff Lenard of the National Association of Convenience Stores.

—

The elimination of the penny highlights the complexity of seemingly small changes in currency production and distribution, emphasizing the need for coordinated action and clear policy to support America’s commerce infrastructure.

https://fortune.com/2025/10/30/america-is-running-out-of-pennies-costing-millions/